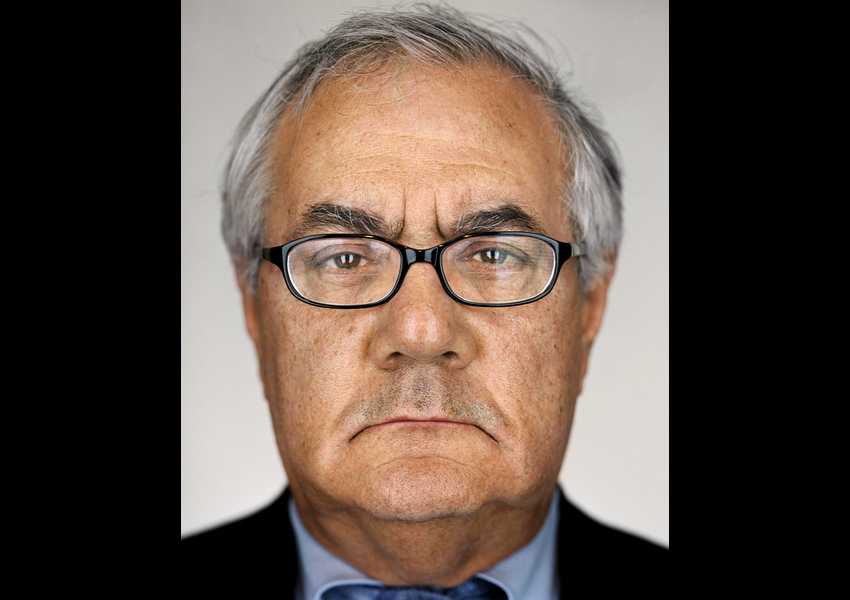

Yes, Barney is guilty. And so are the banks who packaged shit into shinola. We heard from another one of the guilty parties earlier this week:

Steve Liesman interviews Yale Professor Dr. Robert Shiller of the Case-Shiller Index. Shiller maintains that if house prices continue their fall, as he expects, taxpayers could see a $1 trillion loss on Fannie and Freddie. Excellent clip.

---

From Diana Olick at CNBC

So out of the blue this morning I get a bill for anywhere from $221 billion to $363 billion; it wasn't addressed to me alone, but as a taxpayer I tend to take these things very personally.

The "projected" bill came from the overseer of Fannie Mae and Freddie Mac, the FHFA (Federal Housing Finance Agency), which "released projections of the financial performance of Fannie Mae and Freddie Mac, including potential draws under the Preferred Stock Purchase Agreements with the U.S. Department of the Treasury." (You can read the full release here)

It's the bill for the bailout.

So far the Treasury has infused $148 billion to keep Fannie and Freddie afloat; this as their book of business from the height of the housing boom continues to bleed through every band-aid applied. The "projections" released today, "are intended to give policymakers and the public useful snapshots of potential outcomes for the taxpayer support of Fannie Mae and Freddie Mac," writes FHFA Acting Director Edward DeMarco in the release.

So as we approach election day and as we approach the Administration's promised January deadline for a GSE reform game plan, we get to look at some super scary scenarios of what the continuing mortgage mess is going to cost us all. There is a disclaimer: "The results do not define the full range of possible outcomes. This effort should be interpreted as a sensitivity analysis of future draws to possible house price paths."

Okay, now here we go.

The Deeper Second Recession assumes restricted access to credit, continued high unemployment and a reverse in the moderate rebound in home construction we saw in 2009. Peak-to-trough decline is 45 percent with the trough in Q1, 2012. From that trough, prices increase 11 percent through 2013. GSE bill: $363 billion.

---

Eventually the bailout bill will be $1 trillion:

Video: Steve Liesman with Yale Professor Robert Shiller

For American taxpayers, now on the hook for some $145 billion in housing losses connected to Fannie Mae and Freddie Mac loans, that amount could be just the tip of the iceberg. According to the Congressional Budget Office, the losses could balloon to $400 billion. And if housing prices fall further, some experts caution, the cost to the taxpayer could hit as much as $1 trillion.

---

No comments:

Post a Comment