Last week the S&P 500 almost reached an impressive 80 percent gain from the red abyss seen in March of 2009. This puts this stock market rally up in the ranks of the strongest and fastest market turnarounds in history. Yet on Friday news of Goldman Sachs betting on toxic mortgages sold to clients brought the market down as the SEC has finally decided to bring a civil suit forward. Only took a full 27 months of the obvious. The case against Goldman Sachs is a good representation of what our stock market has become especially when it comes to financial institutions and their gaming of the system. Here you have a firm pushing toxic mortgage securities to their own clients yet at the same time, another division of the institutions is betting against the pool of securities because they know that it is junk. This is the story of the current financial system. What use is this really providing the market except enriching the most corrupt and elite financial institutions in the world?

It is fitting that on the same week of the 80 percent rally point, we find out that last month the U.S. saw the largest number of foreclosure filings on record. We also had many states, including the largest with California announcing a new record unemployment rate of 12.6 percent. Do we need more evidence that the stock market does not reflect the health of Main Street? And people act shocked. This is what happens when you inject $13 trillion into the financial sector on the backs of the American public.

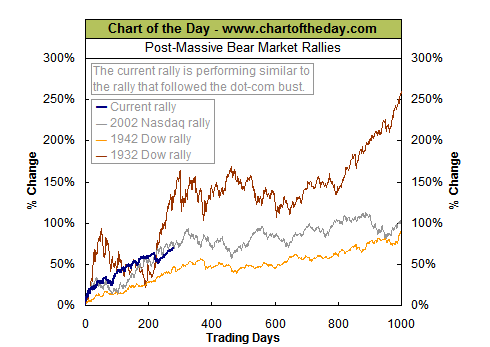

Take a look at the power of this stock market rally:

Source: Chart of the Day

The 1932 stock market rally came after an 89 percent stock market collapse during the bottom of the depression. The 1942 rally came because Europe was bombed into oblivion during World War II and we were producing war goods like crazy. Those models don’t seem to apply today. The NASDAQ collapse is similar to the 1932 chart in that it fell approximately 80 percent from the peak. Today, the stock market is only off by 24 percent from the massive bubble peak achieved in 2007. Yet what has changed? Not much actually in terms of the real economy. Unemployment is still near the peak. We have 40,000,000 Americans on food stamps. Another 15 million are unemployed and another 9 million are working part-time but would like full-time work. This is not a recovery but a clandestine embezzlement of wealth from the overall public, to a select few that are directly linked to Wall Street.

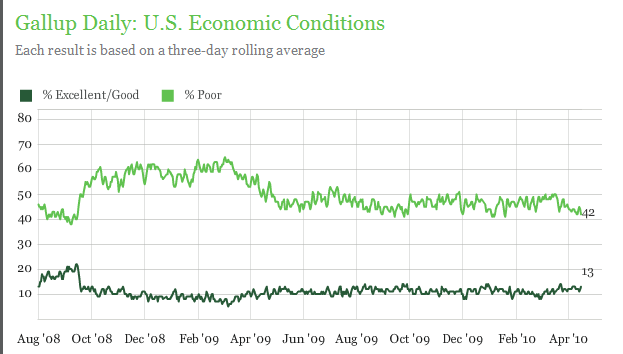

The above information only adds fuel to why 13 percent of the population thinks the economy is doing well:

Let us examine three ways the rich are enjoying the stock market rally while the overall economy is still mired in the pangs of recession.

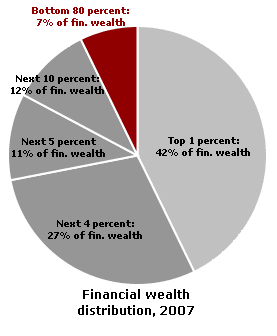

Top 1 Percent Control 40 Percent of Financial Wealth

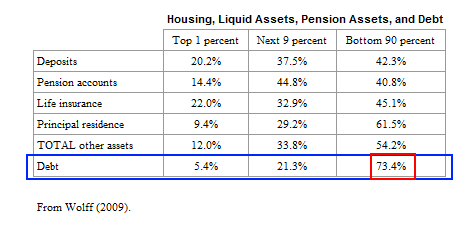

The first obvious reason for why the public is not feeling the enjoyment of the stock market rally is most Americans don’t derive most of their income from stocks:

Source: William Domhoff

We have been bamboozled into believing that wealth is the person who has the most cars or the biggest homes. But that is not necessarily true. Many Americans bought homes that were too big with even bigger mortgages and many have lost those homes. Many have been deceived that wealth is the person that drives the nicest car even if they live in a tiny 500 square foot apartment to pay that enormous lease. True wealth is the actual power base of any economy and that comes from savings (i.e., capital stock, bonds, cash, etc). And financial wealth is the absolute nucleus of power. In the U.S. the top 1 percent control 42 percent of all financial wealth. In other words, this 80 percent stock market rally only applies to the absolute tiniest segment of our population.

That is why even after a near 80 percent stock market rally, the vast majority of Americans have no faith in the economy. Why should they? Most of those profits were brought by firing workers or squeezing productivity of those currently working while wages remain stagnant. Yet this is somehow a recovery? It isn’t and the fact that only 13 percent think things are good is a reflection of this new darker economic reality.

This notion of wealth by getting into debt was followed by many:

So you might say that those that took on too much debt should get their comeuppance. Many are through foreclosure and bankruptcy. Yet that top 1 percent isn’t because they have political connections with the corporatocracy and have managed to swindle trillions of dollars from the public to backup their terrible bets. You pay on both ends. The top 1 percent gets away on both ends.

The reason this problem keeps on going unresolved is that Americans are sold the notion that you too can be the next Horatio Alger. Just pull yourself up from your bootstraps. Good companies strive and bad ones fail is the myth. Yet we all know that isn’t true. Most of the banks would be gone today because what they did was in fact financially stupid. Yet we bailed them out. It is a hypocritical version of capitalism. Adam Smith would be turning in his grave if he saw what was going on today.

Housing Tax Breaks Benefit the Wealthy Disproportionately

Many don’t want to say this but we have subsidized housing enough. Housing is the most heavily subsidized industry in this country:

Source: CNN Money

We give more tax breaks with interest deductions on mortgage interest than any other item. Now this sounds good because many people own homes. Yet people fail to even examine the nuts and bolts of their taxes. People forget that we have standard deductions and the actual housing deduction does not add much when all things are said and done. Plus we have hidden costs that don’t show up immediately through higher taxes and horrible bailouts. Most Americans get a tiny benefit because most live with modest mortgages. Yet the bulk of this benefit once again goes to the wealthiest in this country. If you are paying $20,000 a month in interest on your mortgage do you think you can write more off than say someone who is writing off $800 a month? Who do you think wins here? Do the math. If you think the rich pay just look at this list released by the California Franchise Tax Board of the 250 folks who have actually not paid their taxes.

Yet this is the way things get done by brainwashing the public with crumbs while the rich corrupt the system with gimmicks that are bankrupting our country. It is actually irresponsible to continue giving maximum tax breaks while the country is massively in debt. Why not cap the deduction to the median home price nationwide? That would be fair. Or even cap it at $300,000. Either way, the current structure is merely a way of enriching the top 1 percent by allowing them to write-off giant mortgage interest from their income that many garner from gaming the Wall Street casino.

Going After Food Stamps and Unemployment Insurance

I’ve noticed this absurd trend that started in the last few weeks of going after food stamps and unemployment insurance. This is blatantly absurd and frankly, a disgrace. We spent $53 billion last year for food assistance to 40,000,000 American families. This works out to $1,325 per family for an entire year. We spent that much in one month with the Federal Reserve propping up the mortgage market. Unemployment insurance is keeping this recession from becoming the next depression and leading to a full blown revolution. Yet some people in the media have the gall behind their teleprompter and their comfy corporate media gig to try to eliminate these programs and talk them down.

They argue that food stamps and unemployment insurance keep people unmotivated from looking for work. Do they even realize that we have 6 people for every 1 job opening out there? The vast majority of Americans want to work but can’t find any work (i.e., look at Wall Street profits by slashing and burning American jobs). Yet they talk and talk while their corporate advertisers keep them on the air so they can keep their makeup straight and help them enjoy monthly botox injections. They really have no idea what is out there in the actual economy or the life that many average Americans are living.

Wall Street has polluted the current economy. Most Americans don’t buy the propaganda because all they need to do is look at their monthly paycheck. Or all they need to do is talk with their family and neighbors. Or all they need to do is look at their own retirement plans. We better wake up and do it fast because the wealth is being transferred quick and with no mercy.

No comments:

Post a Comment