Treasury Officials Concerned over Option ARM Recasts and Jumbo Loans Issues – Recalibrating the Housing Numbers while 5.6 Million Mortgages are Delinquent. California One Two Housing Punch. 60 Percent of Option ARMs and 45 Percent of Jumbo Loans in California.

Over the last few months the narrative on the housing situation has morphed into many different shapes. First, it revolved around the need to keep mortgage rates low through the Federal Reserve’s buying of agency debt. The intent was to keep mortgage rates artificially low to stimulate demand. This has propped the market up but the Fed has now taken on nearly $1.25 trillion in mortgage backed securities onto its balance sheet. Next, in the early days of HAMP the program was seen as saving 3 to 4 million homeowners from losing their home. The latest data shows 116,000 permanent modifications which many will re-default in a year or two as new research is showing modified loans have tough times staying current in the long-term.

Another narrative that I have seen take hold is over shadow inventory. Last year as you may recall, a large contingent of those in the real estate industry flatly denied that shadow inventory even existed. Suddenly, shadow inventory exists but won’t be a problem because banks will trickle out inventory in some kind of strategic slow drip plan. This is expected. Back in 2006 and 2007 these people denied any existence of a housing bubble only to be the first in line for taxpayer bailouts when the crisis hit and they had to admit that yes, there was a massive housing bubble. Remember our warnings about those loveable toxic mortgages, options ARMs? Seems like the Treasury is now sounding the horn:

“(Realty Check) Treasury officials today said they are still concerned about a coming wave of foreclosures, many from pay option ARMs and many from the prime jumbo basket, particularly hard hit by unemployment. Only 2/3 of borrowers in the HAMP program are current on their payments. That’s why officials now say they are looking at unemployment options and more incentives to borrowers to keep paying on trial modifications and on loans that are significantly “underwater” with respect to the property value.”

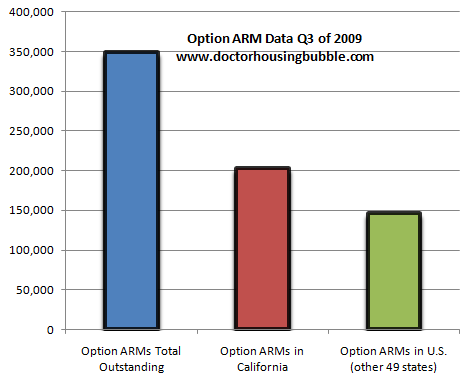

Now anytime the Treasury issues a warning I pause because it is very likely that another bailout is in the works. Option ARMs are the most toxic of mortgages and California by itself has roughly 60 percent of all outstanding option ARMs in the market:

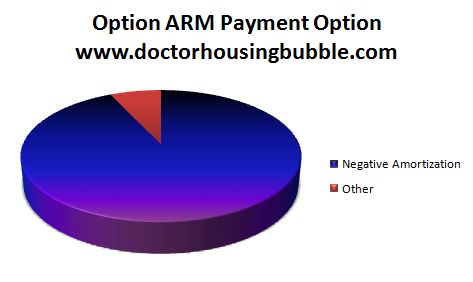

Now looking at the above data, you can understand why the Treasury is worried about this second wave of foreclosures hitting the market. Yet option ARMs were like a bad habit that only went into hiding once the mark to market rules were suspended. These loans are still sitting on the balance sheets of many banks including Bank of America, Wells Fargo, and JP Morgan Chase. And the problem with these loans always revolved around the minimum payment option and their inherent payment insanity:

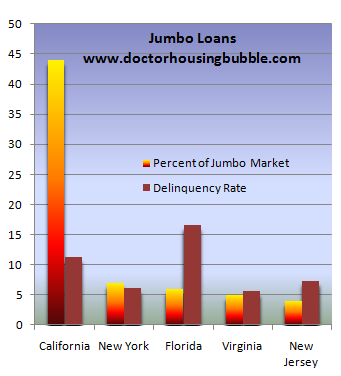

But what is probably even less reported on is the size of jumbo loans that are concentrated in California. California by itself accounts for roughly 45 percent of the entire jumbo loan market and already 11.3 percent of all jumbo loans in California are delinquent:

Source: Fitch Ratings

So when the Treasury states that they are concerned about option ARMs and jumbo loans they pretty much mean they are focusing their eye on California. The bulk of the loans are here. 60 percent of option ARMs are in the state and nearly 45 percent of all outstanding jumbo loans. Yet as we all know option ARMs are already facing major challenges. Nearly half of option ARMs are already 30+ days late. Yet banks are still holding onto these loans usually leaving the market in a state of purgatory where borrowers don’t pay and banks don’t realize actual values since they would have to claim a $600,000 home is now valued at $300,000. Instead, they choose to do nothing. Somehow for those that now acknowledge the shadow inventory this is somehow a good solution.

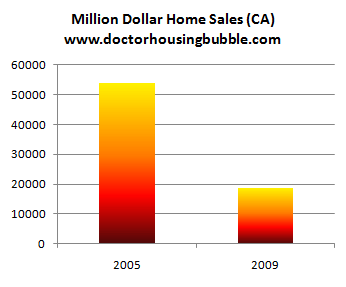

California stands to take another major punch as these loans go bad but more of the correction will be concentrated in mid to upper tier markets. In fact, the million dollar home market is already reflecting this change:

Source: DataQuick

Those that claim the upper tier market isn’t correcting clearly are not following the above sales patterns. And this trend holds even truer for the mid tier market where the capital buffer isn’t deep enough to support highly leveraged toxic loans. Even if you remedy the current loans, what then for future buyers? They don’t have access to option ARMs and clearly their income doesn’t support the purchase of high priced homes without access to maximum leverage. It isn’t like incomes dried up overnight. Income has been stagnant for the decade but access to debt, including option ARMs and jumbo loans allowed California home prices to reach astronomical levels because income suddenly wasn’t a factor. All that was needed was the desire to sign on the dotted line. Option ARMs are now gone and jumbo loans are a tiny part of the market since the bulk of loans are being fed through FHA insured loans and other conforming products. In other words, mortgages for high leverage are now all but gone and as the above chart highlights, so are sales in those markets.

People might be frustrated to hear that a bailout may occur with option ARMs and jumbo loans. Unfortunately many of these loans have already been bailed out with the suspension of mark to market. When we run the shadow inventory figures we see the numbers building up like a massive traffic jam. The defaults are occurring they just aren’t reaching the public and ultimately it is the public that loses because prices remain artificially high. I think most of us would be fine if banks used their own money to play around with their toxic mortgages. But right now, banks are wards of the state and they are bleeding the taxpayer dry through keeping mortgage rates artificially low via the Fed and rewriting accounting rules to suspend mark to market. How is this good for the economy? This massive obsession with real estate has led us to this current point. Paul Volcker recently had this to say about the mortgage market:

“(HuffPo) It’s totally dependent, heavily dependent on government participation,” Volcker said Friday in an interview with Bloomberg Television. “It shouldn’t be that way. That’s going to have to be reconstructed.”

And that is the painful process. California is dealing with tons of toxic mortgage waste, much of it still here. If you don’t believe in my argument, maybe you’ll trust the Treasury that is now echoing the same exact warning regarding option ARMs. As I was finishing this article, I saw this in my e-mail box:

“(Realty Check) The money, we assume, goes to help those ineligible for MHA. This one gives $1.5 billion to the hardest hit states (do I even need to list them? — CA, AZ, NV, FL, MI) to “help address the problems facing the hardest hit housing markets.” White House officials describe this as states that have “suffered an average home price drop of over 20 percent from the peak.”

Initiatives may include:

- Measures for unemployed homeowners;

- Programs to assist borrowers owing more than their home is now worth;

- Programs that help address challenges arising from second mortgages; or

- Other programs encouraging sustainable and affordable homeownership.

The press release from the White House says these programs must have total “transparency” and “accountability” for results. The money will come from the TARP and go to Housing Finance Agencies which will then “determine the priorities facing their local markets.

The release goes on to give “illustrations” of some potential programs, including using the funds to help unemployed borrowers bridge the financial gap between jobs, to help “underwater borrowers” by negotiating with lenders to write down principal and to offer incentives to second lien holders to extinguish loans.”

And there you have it. Another bailout. Small in comparison but a bailout nonetheless. There is going to be a point where the market is going to wake up and say, “can you keep bailing things out when you don’t have the money?” Is this even good policy? I have little problem with helping say a homeowner on a 30 year fixed mortgage in California, Ohio, or even Kansas so long as they didn’t participate in the bubble shenanigans and their mortgage debt is under the median nationwide mortgage debt. But to help an option ARM borrower that took on a $500,000 mortgage without adequate income? That should really be a no brainer. The fact that banks will use money for principal write downs is icing on the cake. Suspend mark to market, receive trillions in taxpayer bailouts, and finally to top it off get more taxpayer money to write down the principal. In the end, home prices will still come down because the economy isn’t producing good paying jobs. Then what use are these bailouts? I think you already know.

No comments:

Post a Comment