Credit cards are ubiquitous like air in the American economy. Virtually every American that can qualify for a credit card has one (or many) in their wallet. Credit card companies have flooded the market with millions of plastic rectangles that have now come back to bite many American consumers. If we rewind back to the early days of this crisis, (so much has happened since that time) we will remember that the banking bailout involved some necessity of keeping credit alive. At least this is how it was presented to the American public. No bailout equaled no access to credit. Yet since that time we have seen consumer credit simply collapse on a record pace. Part of this is due to the extinguishing of debt via bankruptcy but also the fact that credit card companies (aka big banks) are not making loans accessible to the public.

Now banks have shifted gears and are playing on the average American’s need for credit access in a troubled economy. The American consumer is the clutch of this economy and it is burned out. Banks are now saying that they need to be prudent because that is what led them into this mess in the first place. Correct. But that was not the pretense for the bailouts. Now that they have trillions in taxpayer money they have now found some sort of financial religion:

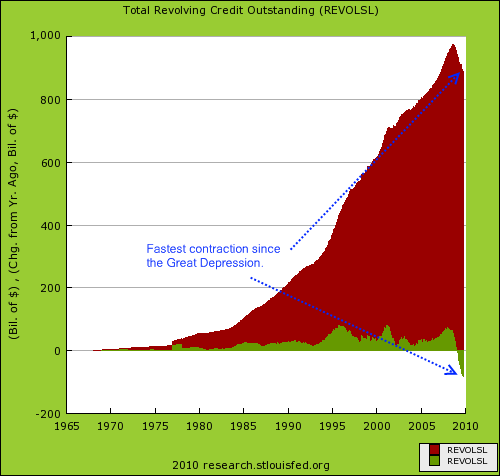

Credit card debt is contracting at its fastest pace since the Great Depression. In fact, over $17 billion in consumer credit was yanked from the market last month. And you don’t need to know the hard data coming out of the Federal Reserve to know this. Just look at your weekly mail:

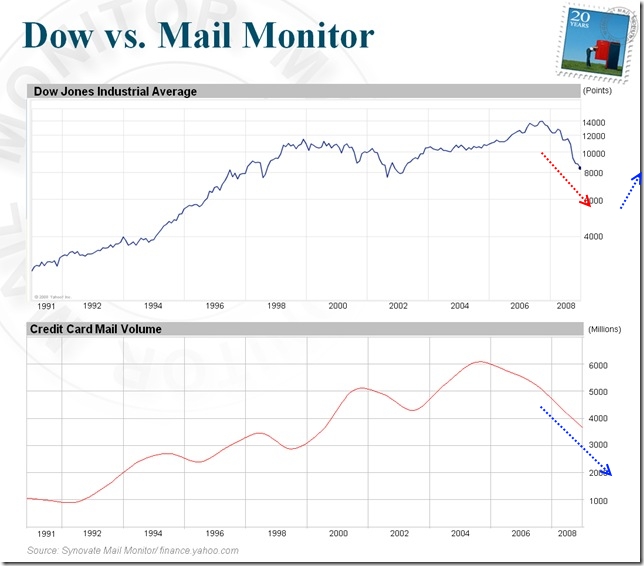

Source: Paul Kedrosky

And of the offers, good luck finding any of those 0 percent offers for 12 months with no fees. Now offers that you get in the mail come with onerous terms, multiple pitfalls, and annual rates that would make your local payday lender look like a generous Midwest banker. Credit card companies are now putting the vice grip on the heads of good paying customers since many of their other “subprime” borrowers are defaulting in mass. Keep in mind these are the borrowers they so heavily recruited during the bubble. After all, we are talking about an industry that gave a cat a $4,000 credit card offer.

During the boom, I would get 3 to 4 offers per day regarding credit cards. Now, it is more like 3 to 4 in a month and the offers are horrible. And the above chart shows that volume has fallen in tandem with the stock market. But unlike the recent stock market rise, credit card offers are still being yanked from average Americans:

“(Synovate) A significant proportion of credit card accounts are being closed, either by issuers or by the consumers themselves due to the change in terms proposed by issuers,” said Anuj Shahani, Director of Competitive Tracking Services for Synovate’s Financial Services Group.

“This was inconsequential initially as issuers were mainly cutting lines on inactive accounts or for transactors, people who pay their balance in full each month. Recently, we are seeing many issuers reduce credit lines on active accounts or for revolvers, people who do carry a balance each month. This can put many households in a risky situation,” he added.

For example, if a household with $25,000 in credit lines across all their cards has one of their $10,000 limit cards cancelled, the credit limit for the household is reduced to $15,000. If they were to revolve on one card with $5,000 as an outstanding balance, their utilization ratio (ratio of outstanding balance to available credit limit) increases from 20% to 33%.

“A utilization ratio above 30% is considered risky by the industry and this makes the household a credit risk in the eyes of most issuers, potentially triggering further reductions in their existing credit limits, making matters even worse,” said Shahani.”

I can tell you from personal experience that this happened to me. One of my credit cards had an excellent fixed rate (something that seemed permanent during the boom times) at 4.99%. Clearly this was a fantastic deal and for years, I kept this card for random purchases. The limit on this card was $5,000 and I rarely put over $1,000 on it. Well all of a sudden once the banks received their bailout money, I get a message saying they are raising their rate to 19.99% because of “adverse changes in the economy” and they needed to be more careful. Very quickly I picked up the phone and called up the number to say I object to the new terms.

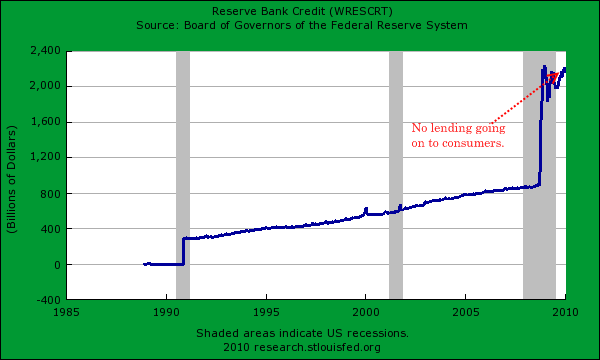

Well after being transferred halfway around the world, I thought all was done. A week later I get a letter telling me my account is closed because of my objection to the new terms. So much for that “permanent” 4.99 percent rate. And you would think that banks have no money to lend right?

Banks are holding over $2 trillion in excess reserves. This is taxpayer money funded through the Federal Reserve and U.S. Treasury. What this actually tells us is that banks are gearing up for more internal problems like the $3.5 trillion implosion of the commercial real estate market or rising defaults. Currently banks have made massive profits by gambling with taxpayer money in the stock markets. The spigot to the consumer is nowhere to be found.

The troubling issue as well is that by closing accounts down debt ratios shoot up and impact credit scores. So by closing down an account, a prudent move on the surface, may actually hurt your overall credit score. And FICO scores carry a lot of weight and unjustifiably so.

But surely those that are getting credit card offers are being given generous terms since banks have been saved by taxpayers:

“Many new card offers now carry an annual fee (30% of the offers in Q3 2009 carried an annual fee versus 28% in Q2 2009). A recent Consumer Confidence Survey conducted by Synovate reported that 15% of consumers said they’d cancel all their credit cards if charged an annual fee and 38% said they’d keep only one card or cancel the ones they don’t use. Another 24% of consumers would look for a card with a lower fee and the rest would take no action.

“Whenever you have a situation where less than a quarter, at best, of customers feel secure, and the rest are either in the process of cancelling their cards or intend to find a new one, it’s reasonable to conclude that the credit card situation remains dire,” Shahani added.”

Not at all. Banks can borrow from the Fed at zero and lend out money at ridiculous rates. Massive margin gains. How else are banks making record profits while unemployment is near the peak and average American are seeing their salaries being slashed?

If you add up the numbers, banks are creating a new debt serfdom for Americans. They are foreclosing on homes at a record pace and pulling back credit even though they explicitly stated that the bailouts were to help the housing industry and keep credit alive. The only housing loans they are making are government backed loans (i.e., Fannie Mae and Freddie Mac conforming)! They won’t even dare put their own money (your money) at risk anymore if they don’t have a government guarantee. With credit cards, it is their money and here they are yanking it all back. This is the plight of our current economy.

No comments:

Post a Comment