The pent up inventory is getting ready to unleash in 2010. The gigantic bet made by the bankers and Wall Street was that somehow by allowing banks to fudge numbers since the crisis started that housing would find its footing and the market would stabilize. Sweep the collapse under the bailout rug. This perceived grounding was then going to allow banks to unload these properties and avoid realizing institutional ending losses. Yet 21 months into this painful recession and trillions handed out to the banking sector, housing prices are not spiking. The tiny uptick in home prices is a mirage brought on by three major factors. First, the $8,000 tax credit lured additional home buyers into the market. Next banks have held back on the shadow inventory thus artificially lowering the supply of homes on the market. Finally, the U.S. Treasury and Federal Reserve have artificially kept mortgage rates low by buying up some $1.25 trillion in mortgage backed securities. All this and housing prices have barely stabilized in some regions while foreclosures are at record breaking heights.

Yet the problem with operating in a crony banking system is that the tainted few are merely looking out for their own gain as they always do. They tried convincing the public that what they were doing was for the good of the average American yet behind the scenes, have shot down cram down legislation at every turn and have their hand out for every bailout. In reality, the current loan modifications are a joke and recent reports by the OCC and OTS show massive amounts of re-default rates.

NPR had a show last week discussing strategic defaults. A strategic default is when someone purposely stops paying even though they have the money to make the payment. This is in contrast to say a job loss default where the person has run out of cash. It was a fascinating show. Many people had little issue with defaulting on their home. Many argued that banks received their bailout so why shouldn’t they? We can thank the government for creating one enormous moral hazard. How can you argue with the borrower’s logic? However there is a problem. The taxpayer is now on the hook for nearly every major bank and let us be honest, the bulk of the mortgages are pumped out by the too big to fail. The government is the mortgage market now. So these strategic defaults are going to harm the average taxpayer even more.

To be honest, I have no problem with people walking away from their mortgage. In a sustainable environment, the punishment to this borrower will be a battered credit score and the inability to buy a home for many years. Yet the government in their infinite wisdom combined with Wall Street felt that by co-opting the banks with taxpayer money, somehow the prudent majority was going to be supportive of all these government handouts to the crony banking system. It is no surprise that people are downright dissatisfied with how things are being operated.

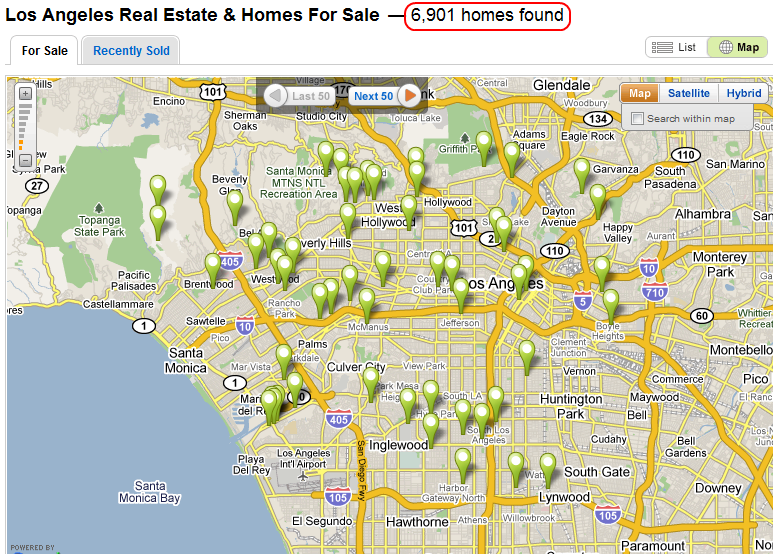

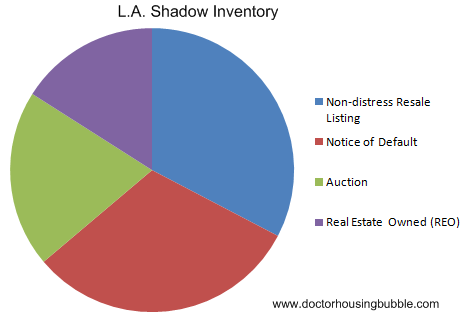

I love how some pundits argue that the shadow inventory will cause no problem on the markets or even, that it doesn’t exist. Keep in mind that we have never had a housing market like this. The Great Depression had a major housing downturn but mortgages were nothing like they are today. At least then, you knew who owned your mortgage. They didn’t have option ARM or toxic nuclear waste Alt-A loans. In fact, many of the prime loans are going bad because people also went HELOC crazy and yanked out equity actually believing their home was worth the inflated price. Let us look at a real case study of shadow inventory. I will use a bigger sample size here and look at Los Angeles:

A quick search of properties shows us some 6,901 homes up for sale. Seems like a small amount of inventory for a big area. But let us add the entire shadow inventory into the mix:

Well isn’t that something? We have 6,901 homes for sale yet we have:

Notice of Defaults: 6,583

Auction: 4,264

Real Estate Owned: 3,376

The shadow market is twice as big as the regular market! This for the biggest area in Southern California! And don’t feed me any of this hogwash that most of these mortgages will be modified. Loans that are modified are re-defaulting by 50, 60, and 70 percent and that is nationwide. Here in California you can imagine what that number will be. Also, many of the option ARMs and Alt-A products don’t even qualify for HAMP or any other loan modification because they are deep underwater. Want to try this exercise on another area? Let us look at Costa Mesa in Orange County for another example:

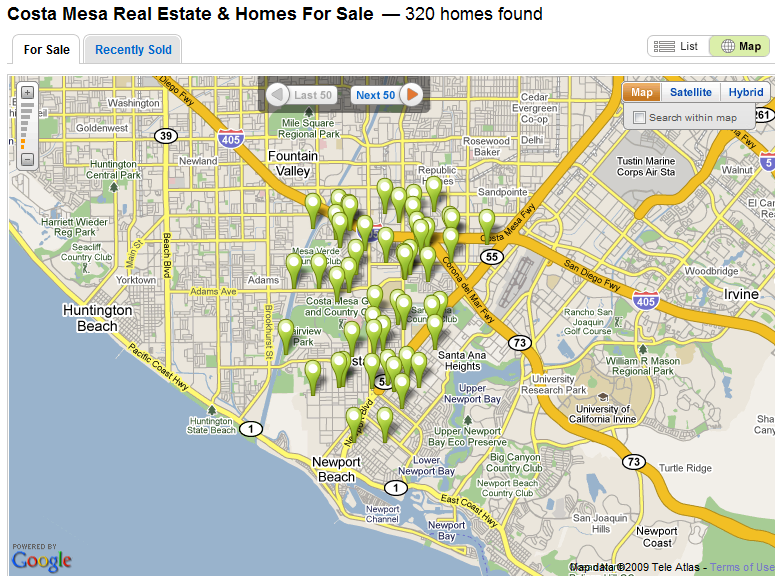

320 homes found. This is probably what your real estate agent is feeding you. But what is the shadow inventory figures?

Notice of Defaults: 227

Auction: 160

Real Estate Owned: 86

The shadow inventory is larger than the actual re-sale number. The reality is that most of these loans won’t cure. Sure, a handful will be modified. But the REO number won’t be modified, the bank already owns these properties. Those scheduled for auction are pretty much a lost cause with the owner. The notice of default data is linked to an audience that is 3 to 6 months behind and given the large mortgage payments in California, if you are this behind chances are you are not catching up. Keep in mind that this data is only for homes that have action being taken on. There is probably a shadow to the shadow inventory! That is, we have heard and know that many banks are not even sending notice of defaults to some late paying borrowers. In other words, there is a boatload of toxic debt out there.

2010 will usher in the recast era of the Alt-A and option ARM tsunami. We’ve talked about this for well over a year. Like subprime, there isn’t much that can be done about this. There are only two scenarios out:

1 – Home prices skyrocket, the employment situation improves, and people can sell out of their problems. Given the 12.2 percent unemployment rate and 23 percent unemployment/underemployment rate in the state, this scenario is highly unlikely. People forget that now that we are back to more conventional lending standards, the easy leverage of the bubble days has caused home buyers to have less pull in buying homes (aka, can’t use other people’s money as easy).

2 – Home prices stagnant, drop in mid to upper tier, and employment remains in the doldrums. This is actually happening. This is our path. Why do you think Realtors are pushing hard for the tax credit to be extended? Why do you think the Fed is still buying up agency debt like an addict? The 30 year fixed mortgage is hovering around 5 percent. The 40 year historical rate for a 30 year fixed mortgage is more like 9 percent. Are they planning on buying agency debt forever? Only if they can convince the world and hold the charade up long enough.

If you haven’t noticed, we have chosen the Japanese option. For Ben Bernanke being an expert on the Great Depression, he is no expert on Japan or doesn’t care we are going to repeat their mistakes. Let us count the ways we are like Japan:

1 – Massive banking bailout and failure to recognize losses. Banks keep walking around like zombies continually eating up resources from the living sectors of the economy.

2 – Real Estate bubble bursting and slow recognition of real losses. Can you say shadow inventory?

3 – Central bank zero bound problems. We didn’t invent quantitative easing!

4 – Massive government spending. Trillions in government injections in Japan and all they got was a 20 year sideways moving market. Stock markets still massively down after two long decades.

You might want to read about the Heisei Bubble for more details. Clearly we are different than Japan in many ways but the above repetition is unmistakable. After 21 months there should be little doubt why our economy is still in a mess. We’ve put the economy on financial Valium and we are trying to pretend that our deep seated problems will go away. We either confront the issues face on or gear up for at least a lost decade for our country. The shadow inventory will depress real estate values for years to come. There are still a few that want the government to buy up all the option ARM and Alt-A junk. You know why that hasn’t happened? Because even the crony Wall Street bankers can’t convince the bailout happy government that these loans are any good. But let us assume we do buy all those toxic loans. Then what? The government will need to sell and face the losses at some point. In the end, price discovery needs to occur. You can’t maintain these bubble prices. Yes, prices in many areas of California are still in a bubble. The dam is going to break one way or another. You can listen to the same dubious folks that missed the biggest collapse since the Great Depression or spend a few minutes looking at the data above and putting two and two together. The path ahead is not good for housing values.

No comments:

Post a Comment