The Crisis in Greece: Will it result in a Haircut “Bail-in” as applied in 2013 in Cyprus?

This article was first published by Global Research in April 2013.

* * *

Is the Cyprus Bank “Bail-in” a “dress rehearsal” for things to come?

Is a “Savings Heist” in the European Union and North America

envisaged which could result in the outright confiscation of bank

deposits?

In Cyprus, the entire payments system has been disrupted leading to the demise of the real economy.

Pensions and wages are no longer paid. Purchasing power has collapsed.

The population is impoverished.

Small and medium sized enterprises are spearheaded into bankruptcy.

Cyprus is a country with a population of one million.

What would happen if similar ‘hair cut” procedures were to be applied in the U.S. or the European Union?

According to the Washington based

Institute of International Finance

(IIF) (right) which represents the consensus of the global financial

establishment, “the Cyprus approach of hitting depositors and creditors

when banks fail, would likely become a model for dealing with collapses

elsewhere in Europe.” (

Economic Times, March 27, 2013).

It should be understood that prior to the Cyprus onslaught, the

confiscation of bank deposits had been contemplated in several

countries. Moreover, the powerful financial actors who triggered the

bank crisis in Cyprus, are also the architects of the socially

devastating austerity measures imposed in the European Union and North

America.

Does Cyprus constitute a “model” or scenario?

Are there “lessons to be learned” by these powerful financial actors,

to be applied elsewhere, at some later stage, in the Eurozone’s banking

landscape?

According

to the Institute of International Finance (IIF), “hitting depositors”

could become the “new normal” of this diabolical project, serving the

interests of the global financial conglomerates.

This new normal is endorsed by the IMF and the European Central

Bank. According to the IIF which constitutes the banking elites

mouthpiece,

“Investors would be well advised to see the outcome of Cyprus… as a reflection of how future stresses will be handled.” (quoted in

Economic Times, March 27, 2013)

“Financial Cleansing”. Bail-ins in the US and Britain

What is at stake is a process of “financial cleansing” whereby the

“too big to fail banks” in Europe and North America (e.g. Citi, JPMorgan

Chase, Goldman Sachs, et al ) displace and destroy lesser financial

institutions, with a view to eventually taking over the entire “banking

landscape”.

The underlying tendency at the national and global levels is towards

the centralization and concentration of bank power, while leading to the

dramatic slump of the real economy.

Bail ins have been envisaged in numerous countries. In N

ew Zealand a “haircut plan” was envisaged as early as 1997 coinciding with Asian financial crisis.

There are provisions in both the

UK and the US pertaining to the confiscation of bank deposits. In a joint document of the Federal Deposit Insurance Corporation (FDIC) and the Bank of England, entitled

Resolving Globally Active, Systemically Important, Financial Institutions,

explicit procedures were put forth whereby “the original creditors of

the failed company “, meaning the depositors of a failed bank, would be

converted into “equity”. (See Ellen Brown,

It Can Happen Here: The Bank Confiscation Scheme for US and UK Depositors,Global Research, March 2013)

What this means is that the money confiscated from bank accounts

would be used to meet the failed bank’s financial obligations. In

return, the holders of the confiscated bank deposits would become

stockholders in a failed financial institution on the verge of

bankruptcy.

Bank savings would be transformed overnight into an illusive concept

of capital ownership. The confiscation of savings would be adopted under

the disguise of a bogus “compensation” in terms of equity.

What is envisaged is the application of a selective process of

confiscation of bank deposits, with a view to collecting debt while also

triggering the demise of “weaker” financial institutions. In the US,

the procedure would bypass the provisions of the Federal Deposit

Insurance Corporation (FDIC) which insures deposit holders against bank

failures:

No exception is indicated for “insured deposits” in the

U.S., meaning those under $250,000, the deposits we thought were

protected by FDIC insurance. This can hardly be an oversight, since it

is the FDIC that is issuing the directive. The FDIC is an insurance

company funded by premiums paid by private banks. The directive is

called a “resolution process,” defined elsewhere as a plan that “would be triggered in the event of the failure of an insurer

. . . .” The only mention of “insured deposits” is in connection with

existing UK legislation, which the FDIC-BOE directive goes on to say is

inadequate, implying that it needs to be modified or overridden. (Ibid)

Because depositors are provided with a bogus compensation, they are not eligible to the FDIC deposit insurance.

Canada’s Deposit Confiscation Proposal

The most candid statement of confiscation of bank deposits as a means

to “saving the banks” is formulated in a recently released document of

the Canadian government entitled

“Jobs, Growth and Long Term Prosperity: Economic Action Plan 2013″.

The latter was submitted to the House of Commons by Canada’s Minister

of Finance Jim Flaherty on March 21 as part of a so-called “pre-budget”

proposal.

A short section of the 400 report entitled “Risk Management Framework

for Domestic Systemically Important Banks” identifies bail-in procedure

for Canada’s chartered banks. The word confiscation is not mentioned.

Financial jargon serves to obfuscate the real intent which essentially

consists in stealing people’s savings.

Under the Canadian “Risk Management” project:

The Government proposes to implement a ‘bail-in’ regime for systemically important banks.

This regime will be designed to ensure

that, in the unlikely event that a systemically important bank depletes

its capital, the bank can be recapitalized and returned to

viability through the very rapid conversion of certain bank liabilities

into regulatory capital.”

This will reduce risks for taxpayers. The

Government will consult stakeholders on how best to implement a bail-in

regime in Canada.

What this signifies is that if one or more banks (or credit unions)

were obliged to “systemically deplete their capital” to meet the demands

of their creditors, the banks would be recapitalized through

“the conversion of certain bank liabilities into regulatory capital.”

The “certain bank liabilities” pertains (in technical jargon) to the

money they owe their customers, namely to their depositors, whose bank

accounts would be confiscated in exchange for shares (equity) in a

“failing” banking institution.

“This will reduce risks for taxpayers” is a nonsensical statement.

What this really means is that the government will not provide funding

to compensate depositors who are victims of a failed banking

institution, nor will it come to rescue of the failed institution.

Instead the depositors will be obliged to give up their savings. The

money confiscated will then be used by the bank to meet their

liabilities contracted with major financial creditor institutions. In

other words, this entire scheme is “a safety net” for too big to fail

banks, a mechanism which enables them as creditors to overshadow lesser

banking institutions including credit unions, while precipitating either

their collapse or their takeover.

Canada’s Financial Landscape

The Risk Management Bail in initiative is of crucial significance for

Canadians across the land: once it is adopted by the House of Commons

as part of the budget package, the Bail-in procedures could be applied.

The Conservative government has a parliamentary majority. There is a good likelihood that the

Economic Action Plan 2013″ which includes the Bail-in procedure will be adopted.

While Canada’s Risk Management Framework intimates that Canada’s

banks “are at risk”, particularly those which have accumulated large

debts (as a result of derivative losses), a generalised across the board

application of the “Bail in” is not contemplated.

The

likely scenario in the foreseeable future is that Canada’s “big five”

banks, Royal Bank of Canada, TD Canada Trust, Scotiabank, Bank of

Montreal and CIBC (all of which have powerful affiliates operating in

the US financial landscape) will consolidate their position at the

expense of lesser (provincial level) banks and financial institutions.

The Government document intimates that the Bail-in could be used

selectively “in the unlikely event that one [bank] becomes non-viable.”

What this suggests is that at least one or more of Canada’s “lesser

banks” could be the object of a bail-in. Such a procedure would

inevitably lead to a greater concentration of bank capital in Canada,

to the benefit of the larger financial conglomerates.

Displacement of Provincial Level Credit Unions and Cooperative Banks

There is an important network of over 300 provincial level credit

unions and cooperative banks including the powerful Desjardins network

in Quebec, the Vancouver City Savings Credit Union (Vancity) and the

Coastal Capital Savings in British Columbia, Servus in Alberta, Meridian

in Ontario, the caisses populaires in Ontario (affiliated to

Desjardins), among many others, which could be the target of selective

“Bail-in” operations.

In this context, what is likely to occur is a significant weakening

of provincial level cooperative financial institutions, which have a

governance relationship to their members (including representative

councils) and which, in the present context, offer an alternative to the

Big Five chartered banks. According to recent data, there are more than

300 credit unions and

caisses populaires in Canada which are members of the “Credit Union Central of Canada”.

New Normal: International Standards Governing the Confiscation of Bank Deposits

Canada’s

Economic Action Plan 2013″ acknowledges that the proposed

Bail-in framework

“will be consistent with reforms in other countries and key

international standards”. Namely, the proposed pattern of confiscating

bank deposits as described in the Canadian government document is

consistent with the model contemplated in the US and the European

Union. This model is currently a “talking point” (behind closed doors)

at various international venues regrouping central bank governors and

finance ministers.

The regulatory agency involved in these multilateral consultations is

the Financial Stability Board (FSB) based in Basel, Switzerland and

hosted by the Bank for International Settlements (BIS) (image right).

The FSB happens to be chaired by the governor of the Bank of Canada,

Mark Carney, who was recently appointed by the British government to

head the Bank of England starting in June 2013.

Mark

Carney, as Governor of the Bank of Canada, was instrumental in shaping

the provisions of the Bail-in for Canada’s chartered banks. Before his

career in central banking, he was a senior executive at Goldman Sachs,

which has played a behind the scenes role in the implementation of the

bank bailouts and austerity measures in the EU.

The FSB’s mandate would be to coordinate the bail-in procedures, in

liaison with the “national financial authorities” and “international

standard setting bodies” which include the IMF and the BIS. It should

come as no surprise: the deposit confiscation procedures in the UK, the

US and Canada examined above are remarkably similar.

Bank “Bail-ins” vs. Bank “Bail-outs”

The bailouts are “rescue packages” whereby the government allocates a

significant portion of State revenues in favor of failed financial

institutions. The money is channeled from the coffers of the State to

the banking conglomerates.

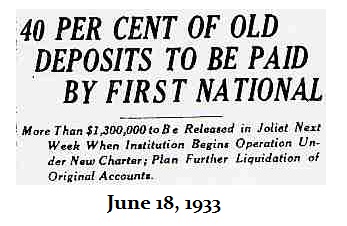

In the US in 2008-2009, a total of $1.45 trillion was channeled to

Wall Street financial institutions as part of the Bush and Obama rescue

packages.

These bailouts were considered as a

De facto government

expenditure category. They required the implementation of austerity

measures. Together with massive hikes in military expenditure, the

bailouts were financed through drastic cuts in social programs including

Medicare, Medicaid and Social Security.

In contrast to the Bailout, which is funded from the public purse,

the “Bail-in” requires the (in-house) confiscation of bank deposits. The

bail-ins are implemented without the use of public funds. The

regulatory mechanism is established by the central bank.

At the outset of Obama’s first term in January 2009, a bank bailout

of the order of $750 billion was announced by Obama, which was added on

to the 700 billion dollar bailout money allocated by the outgoing Bush

administration under the Troubled Assets Relief Program (TARP).

The total of both programs was a staggering 1.45 trillion dollars to

be financed by the US Treasury. (It should be understood that the actual

amount of cash financial “aid” to the banks was significantly larger

than $1.45 trillion. In addition to this amount defence allocations to

fund Obama’s war economy (FY 2010) was a staggering $739 billion. Namely

the bank bailouts plus defence combined ($2189 billion) eat up almost

the totality of the federal revenues which in FY 2010 amounted to $2381

billion.

Concluding remarks

What is occurring is that the bank bailouts are no longer functional.

At the outset of Obama’s Second term, the coffers of the state are

empty. The austerity measures have reached a deadlock.

The bank bail-ins are now being contemplated instead of the “bank bailouts”.

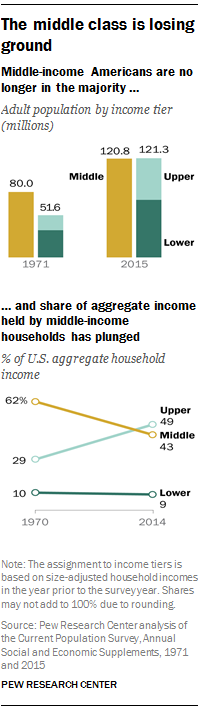

The lower and middle income groups which are invariably indebted will

not be the main target. The appropriation of bank deposits would

essentially target the upper middle and upper income groups which have

significant bank deposits. The second target will be the bank accounts

of small and medium sized firms.

This transition is part of the evolution of the global economic

crisis and the impasse underlying the application of the austerity

measures.

The purpose of the global financial actors is to wipe out

competitors, consolidate and centralize bank power and exert an

overriding control over the real economy, the institutions of government

and the military.

Even if the bail-ins were to be regulated and applied selectively to a

limited number of failing financial institutions, credit unions, etc,

the announcement of a program of confiscation of deposits could

potentially lead to a generalized “run on the banks”. In this context,

no banking institution would be regarded as safe.

The application of Bail-in procedures involving deposit confiscation

(even when applied locally or selectively) would create financial havoc.

It would interrupt the payments process. Wages would no longer be paid.

Purchasing power would collapse. Money for investment in plant and

equipment would no longer be forthcoming. Small and medium sized

businesses would be precipitated into bankruptcy.

The application of a Bail-In in the EU or North America would

initiate a new phase of the global financial crisis, a deepening of the

economic depression, a greater centralization of banking and finance,

increased concentration of corporate power in the real economy to the

detriment of regional and local level enterprises.

In turn, an entire global banking network characterized by electronic

transactions (which govern deposits, withdrawals, etc), –not to mention

money transactions on the stock and commodity markets– could

potentially be the object of significant disruptions of a systemic

nature.

The social consequences would be devastating. The real economy would plummet as a result of the collapse in the payments system.

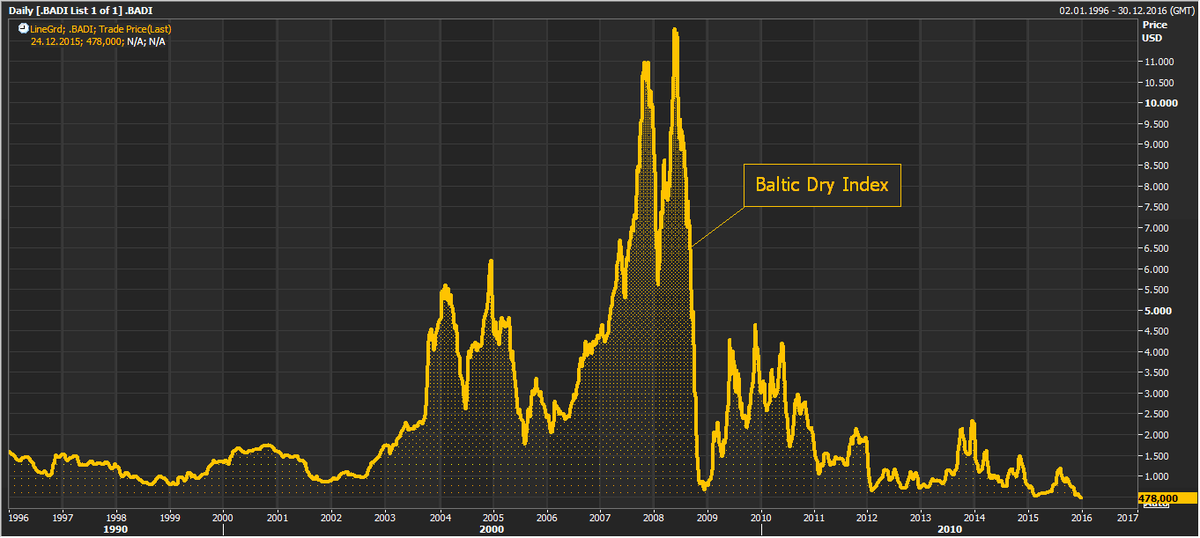

The potential disruptions in the functioning of an integrated global

monetary system could result in a a renewed global economic meltdown as

well as a drop off in international commodity trade.

It is important that people across the land, in the European Union

and North America, nationally and internationally, forcefully act

against the diabolical ploys of their governments –acting on behalf of

dominant financial interests– to implement a selective process of bank

deposit confiscation.

ORDER DIRECTLY FROM GLOBAL RESEARCH

Michel Chossudovsky and Andrew Gavin Marshall, Editors $16.00

Save 38%

The original source of this article is Global Research

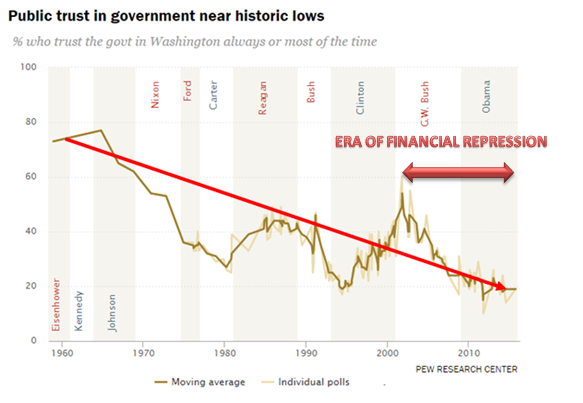

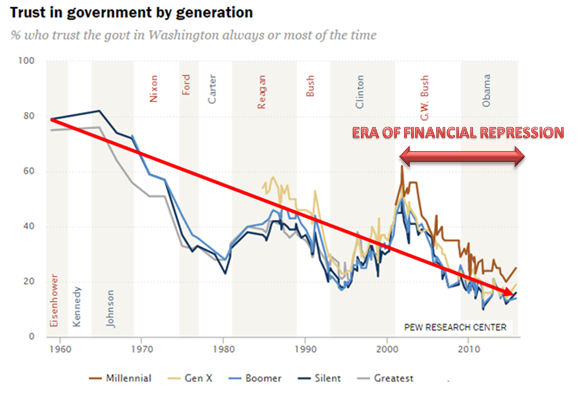

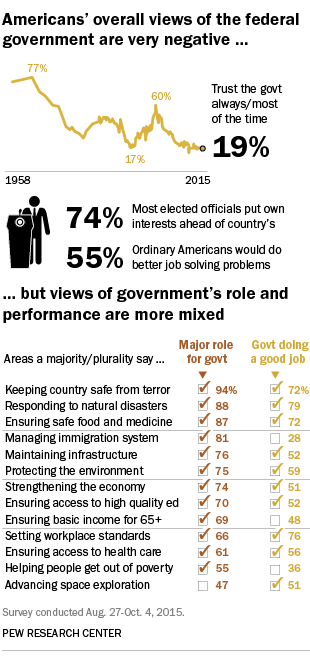

While

Democrats are more likely than Republicans to say they trust the

government, trust remains low across partisan lines: Just 11% of

Republicans and Republican-leaning independents say they trust the

government, compared with 26% of Democrats and Democratic leaners. (For more on the public’s trust in government, see

While

Democrats are more likely than Republicans to say they trust the

government, trust remains low across partisan lines: Just 11% of

Republicans and Republican-leaning independents say they trust the

government, compared with 26% of Democrats and Democratic leaners. (For more on the public’s trust in government, see