The Nasdaq

Biotech Index had beautifully shot up along an exponential curve.

Then the hot air hissed out of it, and it swooned 21% in six weeks.

The index includes big players, like Biogen, not just startups with

big dreams and no drugs. After some buying on the dip, the index

closed on Thursday down “only” 15%. But that hasn’t saved

smaller momentum stocks: Exelixis is down 58% from its 52-week high

and 92% from its all-time high shortly after its IPO in early 2000;

Halozyme is down 60% from its high in early January. And so on.

In the social media space, the bloodletting has

been ugly. The Social Media ETF SOCL is down 23%, but stronger stocks

like Facebook (down 16% from its high a month ago) paper over

individual fiascos, like Twitter, which has plummeted 48% from its

peak last year to below its IPO price.

Other momentum stocks are getting annihilated:

Amazon down 25% since January, Netflix down 27% in just two months.

From their peaks, Pandora crashed 39%, Gogo 63%, and Imperva, a Big

Data security outfit, 65%.

Then there’s the “Cloud,” the single most

hyped miracle-sector last year. Escalator up, elevator down. Workday,

which sells cloud-based corporate software, went public in late 2012

and soared. Two months ago, it sprung a leak and the hot air hissed

out of it. It’s down 36%. Veeve, which sells cloud-based healthcare

software, has crashed 60% from its November high, shortly after it

had gone public. Salesforce is down 22%. ServiceNow lost 30% over the

past two weeks. LinkedIn reported a loss after hours on Thursday and

got hammered. It’s now down 40% from its peak last September. Jive

Software is down 71% from its high in 2012….

Twitter

Tumbles 50% From Recent All Time Highs

Which leaves TWTR trading at a 50% discount

from its recent all-time highs…

Twitter

shares slump as lock-up period ends

Social-network’s

stock falls almost 10% as many insiders are expected to cash in

Q1

GDP Cut To -0.6% At Goldman, -0.8% At JPMorgan

Update: JPM

just jumped on the bandwagon and cut Q1 GDP to -0.8% from -0.4%.

Don’t worry: it snowed.

The US “recovery” is starting to feel more

and more recessionary by the day. As we warned after we reported the

trade deficit, it was only a matter of time before the Q1 GDP cuts

came. And come they did, first from Barclays, and now from Goldman,

which just doubled its GDP forecast loss for the past quarter from

-0.3% to -0.6%.

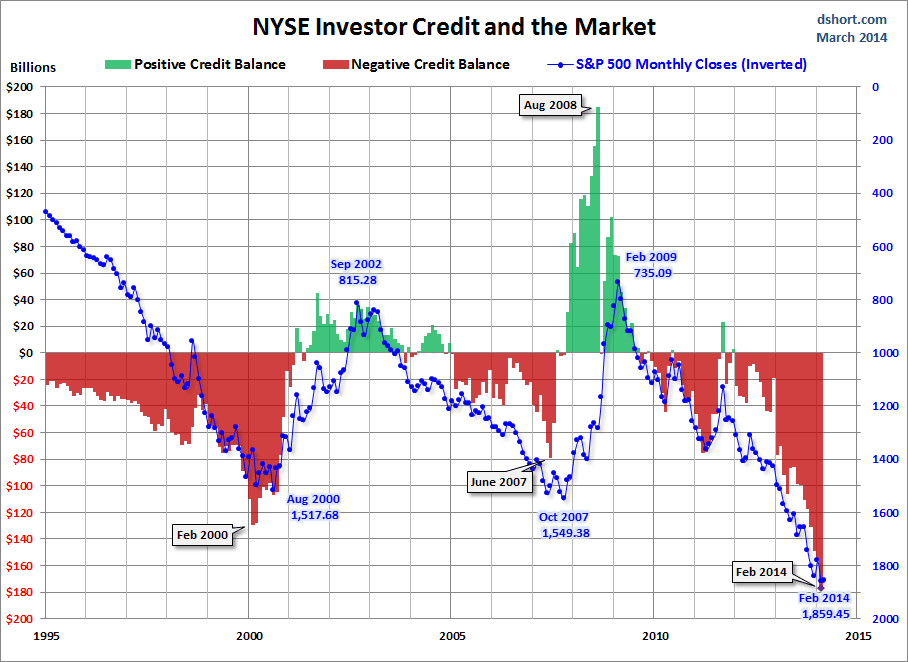

What is being used to push up stocks is RECORD

HIGH LEVELS OF MARGIN DEBT just like was the case before the crashes

of 1929, 1973, 1987, 2000, and 2008, and that has nothing whatsoever

to do with QE or the Federal Reserve.

Rates on credit cards have NEVER BEEN HIGHER

and now have a national average of 21%. The Federal Reserve has

nothing to do with equity “investment” at all and it doesn’t

matter a hoot what the only 2 rates set by the Federal Reserve are.

Average

credit card interest up to shocking 21%

Speculating with credit like there’s no

tomorrow – Bubble Bubble

Annual home-price growth posts sharpest

slowdown in three years

Home prices rose in March, with certain

regional markets posting fresh peaks, while the U.S. as a whole saw a

sharp slowdown in annual growth, according to data released Tuesday.

Chas Caldwell

No comments:

Post a Comment