by

GoldCore

- Gold has risen 11% versus the euro in 2015

- Builds on 12% gains against the euro in 2014

- Sentiment poor despite reasonable performance

- Gold performing well considering significant gains in stocks and dollar

- Dollar centric view misleading

- Currency wars intensifying

- Complacency and hubris rife

Gold rose 12% against the euro in 2014 and so far

in 2015, gold has risen a further 11% versus the euro. The euro has

fallen 23% against gold since January 2014. Gold has risen from EUR 880

per ounce in January 2014 to EUR 1,090 per ounce today.

image: http://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/03/goldcore_bloomberg_chart4_12-03-15.png?38af09

The dollar-centric nature of most financial media and the tendency to

focus on gold solely in dollars would give one the impression that gold

has been devastated this year.

In dollar terms gold has not fared terribly well,

its true, but that is more a function of the surge in the dollar than of

weakness in gold. Gold’s performance has been quite good considering

the significant strength in the dollar and the gains seen in stock

markets.

Gold has an inverse correlation with the dollar and stocks over the long term.

How much longer the stock and dollar boom can continue in the face of

deteriorating macro-economic data – the worst since the 2008 crisis –

is anyone’s guess. The Federal Reserve, like its other central bank

counterparts, has done an incredible job in levitating markets and risk

assets thus far.

The dollar has soared against most of the currencies in the world but

has only eked out very small gains versus gold. Gold has fallen just

2.7% in dollar terms.

When measured against other currencies, gold has risen versus many

major currencies. In fact, it has only suffered modest declines in a few

currencies this year. Despite, all the negative gold sentiment against

the backdrop of central banks globally racing to debase their

currencies.

image: http://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/03/goldcore_bloomberg_chart1_13-03-15.png?38af09

Priced in euros, gold opened the year at EUR

980.52. It quickly spiked to EUR 1,154.94 before what appears to be a

50% retrenchment. It then picked up again and at the time of writing, it

is priced around the EUR 1,092 mark. So in Euro terms gold is actually

up around 11% this year.

In GBP gold followed roughly the same pattern but did not rebound so

well due to recent sterling strength and is currently trading slightly

above its price at the start of the year.

We expect qold to be supported in the near term and to rise in the

longer term as the ECB lurches into its QE program. The expectation that

the ECB will inject massive liquidity into the financial system by

buying up bonds en masse has been met with unquestioning enthusiasm.

image: http://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/03/goldcore_bloomberg_chart2_13-03-15.png?38af09

We do not share this enthusiasm. The anticipation

of this monetary experiment has already caused the euro to plunge. This

should aid exporters in the coming months. But in the longer term it

will lead to inflation as importers have to pay more for their raw

materials and the public have to pay higher prices for imported goods.

Also of vital importance is that most central banks are involved in competitive currency devaluations.

Therefore, in the medium and long term, currency devaluations will be

of little benefit to exporters as most central banks are engaged in the

same ‘beggar thy neighbour’ trade and

currency wars.

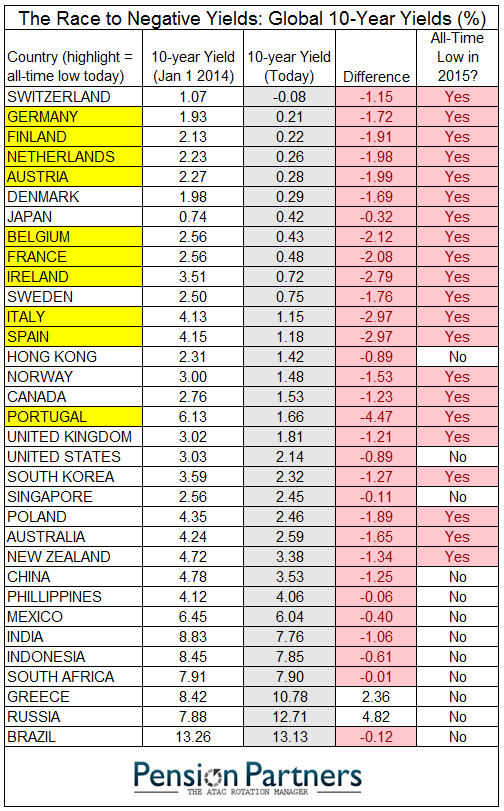

So far this year twenty four central banks globally have lowered

interest rates in a bid to weaken their currencies to aid their export

sectors and create jobs and economic growth.

The haphazard manner in which this QE experiment is being executed in

the EU is also concerning. In the absence of a truly centralised

central bank it has fallen to national central banks to purchase the

bonds that will create a sustainable recovery. The lack of oversight is

ripe for abuse of the system.

The experiment has only been in operation for four days and already

there are serious questions over whether it can be actually implemented

as planned. Due to arcane accountancy rules governing the quality of

bonds which may be purchased it appears that there simply may not be

enough bonds to meet demand.

Given that the ECB flagged its intention to engage in QE long in

advance, the bond markets have already factored in anticipated massive

central bank purchases. If it turns out that the central banks cannot

buy their expected allocation of bonds it will likely cause chaos in the

bond markets.

The uncertainty now hanging over the European bond markets cannot

have been alleviated by reports that Greek Finance Minister Varoufakis

said on Tuesday that “Greece would never pay back its debts,” which was

followed by Prime Minister Tsipras confirming that “Greece cannot

pretend its debt burden is sustainable.”

Greece’s future in the Eurozone is still questionable. The BBC is now

warning that Greece may be pivoting towards Russia. They report that a

“drove of Greek cabinet members will be heading to Moscow” in May, a

month before the current bail-out arrangement expires.

Anticipation of ECB QE has also caused European

stock markets to rise considerably. These price rises have not been

matched by a rise in earnings or dividends indicating a liquidity driven

bubble in some European and other indices.

image: http://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/03/goldcore_bloomberg_chart3_13-03-15.png?38af09

By some measures, US stock markets are more overvalued than they were in 2008.

The subprime bubble and meltdown of 2007 has now been surpassed by

large bubbles in auto loans, student loans, many tech and biotech

stocks, junk bonds and other sections of the bond market.

Compounding the risks is the fact that there is now $8 trillion more in public and private debt in just the United States alone.

The imbalances, distortions and malinvestment that caused the 2008

meltdown are much worse today than they were in 2008. As is the

complacency and hubris.

And many of the same people who got us into this mess remain at the

helm and are pursuing the same ultra loose monetary policies that got us

into the debacle.

Given the risks of today – the euro and other currency QE

experiments, competitive currency devaluations, currency wars, bail-ins,

stock and bond market bubbles – gold will continue to protect and grow

wealth over the long term.

Download Insight: Currency Wars: Bye Bye Petrodollar – Buy, Buy Gold

MARKET UPDATE

Today’s AM fix was USD 1,156.50, EUR 1,091.24 and GBP 779.58 per ounce.

Yesterday’s AM fix was USD 1,161.25, EUR 1,094.90 and GBP 774.48 per ounce.

Gold fell 0.06% percent or $0.70 and closed at $1,153.30 an ounce

yesterday, while silver climbed 0.45% or $0.07 to $15.57 an ounce.

image: http://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/03/goldcore_bloomberg_chart5_13-03-15.png?38af09

In

Singapore, bullion

for immediate delivery inched up 0.5 percent to $1,159.30 an ounce near

the end of day trading. The yellow metal has seen nine straight

sessions of losses which equates to its longest losing streak since

August 1973, when it fell for ten consecutive days.

In London, spot gold is trading at

$1,156.88 or up 0.24 percent. Silver is down 0.49 percent at $15.56 and

platinum is up 0.45 percent at $1,123.42.

Gold Sentiment Very Poor As Speculators Sell Yet Bullion Demand Robust

Gold looks to be headed for its sixth weekly drop in seven weeks.

Sentiment towards gold is quite negative after the recent price falls.

Gold has been pressurised by liquidations from the more speculative

side of the market – with ETFs and in the futures market. Holdings in

the SPDR Gold Trust, the world’s largest gold exchange-traded fund, fell

0.28 per cent to 750.95 tonnes on Thursday – the lowest since late

January.

image: http://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/03/goldcore_bloomberg_chart4_13-03-15.png?38af09

Unusually, the fund hasn’t seen any inflows since February 20 – see

chart on flows into the ETF, and how it’s been tracking gold prices,

although gold has fallen by much more than the ETF holdings.

Gold is weaker and yet, there has been very little

liquidations of physical coins and bars and bullion demand in China and

India remained robust in recent weeks and actually picked up this week.

Premiums in India remain close to $2 and in China they remain over $5 per ounce.

Reuters report that traders in Asia spoke of robust demand this week.

“Demand has increased a little bit because of the drop in prices but

there is no big rush,” said Bachhraj Bamalwa, director at the All India

Gems and Jewellery Trade Federation.

Asian buyers again are using weakness in gold and silver prices to accumulate bullion.

U.S. Mint figures show demand has been robust in March. Sales of gold

American Eagle coins by the U.S. Mint have been strong, already almost

matching last March’s total (at 20,500 oz so far this month, vs 21,000

oz last year) and outstripping February’s (18,500 oz).

Silver American Eagle sales aren’t doing so well, however. Sales

total 1.3735 million so far this month, compared to 3.022 million oz in

February and 5.354 million oz in March 2014.

Interestingly, according to Amanda Cooper of Thomson Reuters posting in the Global Gold Forum:

“Until yesterday, gold had fallen for 8 days in a row, which is

pretty steep going even for the gold market when it gets gloomy. The

last time gold fell that many days in a row was March 2009.

A closer look at the chart reveals that gold has only ever fallen

by that many days in a row three times since the gold standard was

abolished in the 1970s. Since Reuters gold data began in 1968, gold has

only fallen for 9 days once, back in August 1973.”

It is worth noting that in the months following the 8 days of falls

in 2009, gold prices surged.Gold rose from $892 per ounce in March 2009

to over $1,200 per ounce just 8 months later in November 2009. This was a

rise of nearly 35%. A similar rise today would see gold rise from

$1,155 per ounce today to over $1,550 per ounce.

Caveat emptor and past performance is no guarantee of future returns.

It takes a brave or foolish investor to buy after such price falls and we always caution never to “catch a falling knife.”

However, an attractive buying opportunity looks set to soon present itself.

Dollar, pound and euro cost averaging into a physical position remains prudent.

Updates and Award Winning Research Here