While Russia is of course

guilty of

crimes, the US is

guilty of the same and far

worse crimes, and is

fervently supporting many

other criminal

groups and states. Thus, to understand why US extremists (

not the US

public) in

control of the state are putting us all in serious potential danger by

choosing to target nuclear Russia, we have to look back, and, of course,

beyond the

narrative peddled by the aggressors themselves.

…

In 1918, US oligarchs and religious extremist Woodrow Wilson sent

about 13,000 young American men to join tens of thousands of others from

a Western-dominated axis and illegally invade Russia with intent to

commit premeditated mass murder.

“Two years and thousands of casualties [including ~400 US] later,” Blum

notes,

“the American troops left, having failed in their mission to ‘strangle

at its birth’ the Bolshevik state, as Winston Churchill put it.”

Churchill further admitted that the Western axis forces were “invaders”

who shot Russians on sight, blockaded their ports, sank their ships,

and armed their enemies.

The British in Russia in 1918 committed what at the time was

considered the ultimate conceivable atrocity: they killed people with

chemical weapons – poison gas – as Churchill

suggested the British Empire should also do against Iraqi civilians, in the hope of spreading what he called “a lively terror”.

The 1917 Bolshevik Revolution, Chomsky, Gaddis (Professor of military

and naval history, Yale), and other historians find, was the real

beginning of the US “cold” war against Russia, which has continued

essentially without break and is today being

spiked by US strongman Barack Obama and his

cadre.

Gaddis says the 1917 Western aggressive invasion of Russia was

perpetrated to ensure the “survival of the capitalist order” in the face

of what was called a “communist threat”. Chomsky notes that by this

logic, since the US threatens

to – and does – globally enforce what is called “capitalism” (the

“capitalist threat”), then anyone who wants to ensure the survival of a

different order would likewise “be entirely justified in carrying out a

defensive invasion of the US”, and using chemical weapons, or, “if they

don’t have the power for that”, committing one-off attacks like “blowing

up the World Trade Center” (Chomsky of course says this to expose the

hypocritical aggressor’s logic).

By “capitalist order”, Gaddis refers to Western oligarchic top down dominance of society, the system that,

while ~100

million deaths occurred worldwide under so-called “communism”, ~100

million deaths simultaneously occurred under so-called “capitalist”

India alone. As experts put it,

while China

was bringing some six hundred million people out of poverty (U.N.

stat), an achievement unparalleled in history, “every eight years, India

put as many skeletons in its closet” as China did during its years of

famine. When the number of people killed under what is called

“capitalism” is extended beyond India to the rest of the world, Chomsky

notes, “it would be colossal.” In the West, he continues, only the

“communist” death numbers can be mentioned. As for the number of

“capitalist” deaths, one “wouldn’t talk about them”.

The

“colossal” death figures flowing from their system being of no concern

and, perhaps, some satisfaction to oligarchs*, and their ever-increasing

personal enrichment at the expense of others being of chief import,

their “order” had to be preserved, their brutal march of expansion

forced onward. Hence, the insolent 1917 Russian notion of a

modification to the oligarchic order in which Russians were on the

bottom had to be, as Churchill noted, snuffed out immediately. The

threat of an internal change in Russia, Chomsky notes, referring to a

1955 US study, was that places like Russia and Eastern Europe generally,

the components of the original “third world”, which had long been made

to provide cheap labor and resources for the Western oligarchy, were

reducing their “

willingness” to “complement the industrial economies of the West, which is the job of the Third World.”

That, Chomsky says, agreeing with Gaddis and others, was the actual “threat of communism” that was immediately understood and acted on by Western oligarchs in 1917.

Indeed, as

racial supremacist Woodrow Wilson, who spokes-headed the US in 1918 when it invaded Russia, secretly

noted:

“Since trade ignores national boundaries and the manufacturer insists

on having the world as a market, the flag of his nation must follow

him, and the doors of the nations which are closed against him must be

battered down. Concessions obtained by financiers must be safeguarded by ministers of state, even if the sovereignty of

unwilling nations

be outraged in the process. Colonies must be obtained or planted, in

order that no useful corner of the world may be overlooked or left

unused.”

Wilson’s imagery of using armed men to batter in closed doors and

physically force the “unwilling” to submit to the desires of

“manufacturers” and “financiers” sheds light on the words of Indian

writer Arundhati Roy, who said “Those of us who belong to former

colonies think of imperialism as rape.”

But the unwilling people of the Soviet Union, despite being raped “in

[the] cradle” by Western oligarchs, had “managed to survive to

adulthood.” Thus, they had to be raped again by the West, “by the Nazi

war machine with the blessings of the Western powers” (Blum). This

time, as many as

40 million Russians, amounting to perhaps a third of the Russian population, were exterminated.

…

In 1991, even when the Soviet Union, sufficiently

battered and now the Russian Federation, finally “

reopened” to Western-style

oligarchic plunder,

the West was still unsatisfied. While maintaining in Latin America and

elsewhere the terror regimes that Chomsky points out are overwhelmingly

documented in scholarship to have been worse than the satellites

maintained by the Soviets, insatiable US controllers now began

penetrating east through Europe with their “NATO” military

installations, which they had dishonestly claimed only existed to

counterbalance the Soviet Union. When Russian leaders pointed out that

NATO expansion was in violation of specific US promises not to move NATO

“one inch east”, US reps essentially replied that if anyone is stupid

enough to expect them to honor their word, that is their problem – a

point impossible to contest.

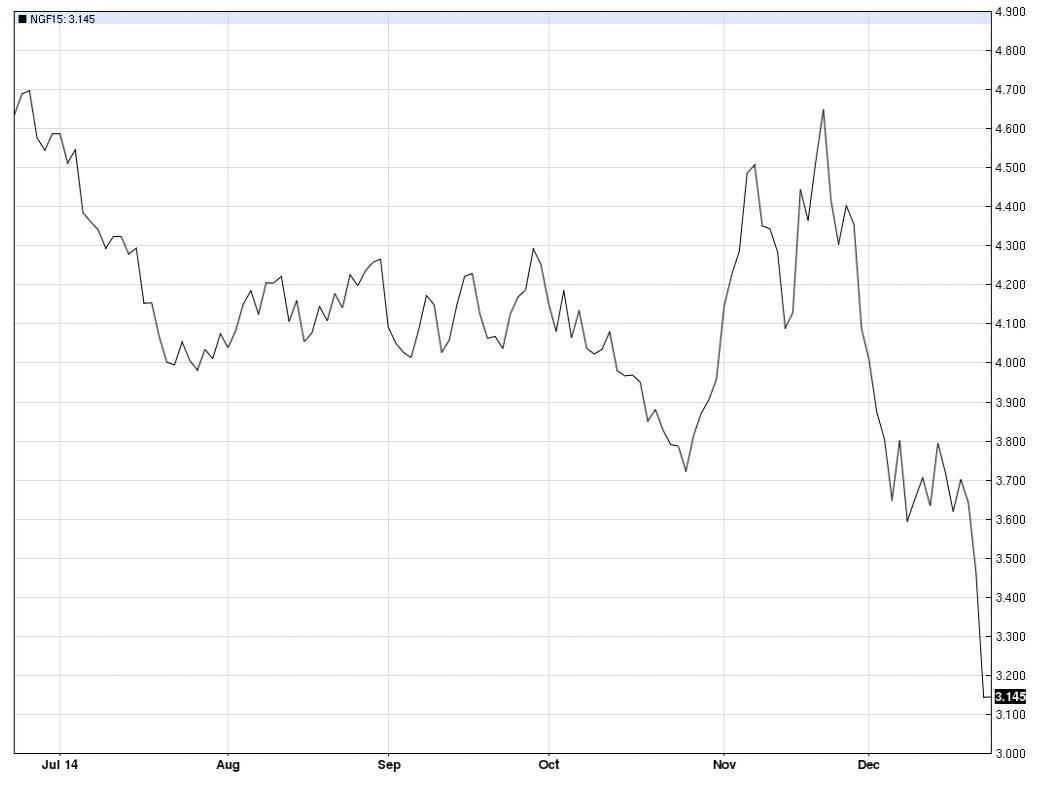

Currently, US oligarchs are using siege tactics to intentionally target

all

143 million Russian civilians in attempt to expand their “order” of

top-down control, exploitation, and mass death over Russian resources

and labor. In addition to this aim, perhaps these US extremists will

succeed in bringing capital punishment back to Russia, will be able to

vastly expand the Russian prison system to mirror the highly profitable

one of the US, revoke paid maternity leave, revoke Russia’s ratification

of the UN declaration on the rights of children, and make other changes

US oligarchic media outlets insist are attributes of “freedom” and

other keywords.