by

David Stockman

According to Takahiro Mitani, trashing your currency, destroying your

bond market and gutting the real wages of domestic citizens is a sure

fire ticket to economic success. Yes, that’s what the man says,

“I have no doubt that the economy is in a recovery trend if you look at the long run….”

After two years of hoopla and running the BOJ’s printing presses red

hot, however, there is not a shred of evidence that Abenomics will lead

to any such thing. In fact, after the recent markdown of Q3 GDP even

deeper into negative territory,

Japan’s real GDP is no higher now than it was the day Abenomics was launched in early 2013; and, in fact, is no higherthan it was on the eve of the global financial crisis way back in 2007.

In the meanwhile, the Yen has lost 40% of its value and teeters on

the brink of an uncontrolled free fall. Currency depreciation, of

course, is supposedly the heart of the primitive Keynesian cure on which

Abenomics is predicated, but there is no evidence or honest economic

logic to support the proposition that—–over any reasonable period of

time—–a nation can become richer by making its people poorer.

That’s especially true in the case at hand, which is to say,

a Pacific archipelago of barren rocks. Japan imports virtually 100%

of every BTU and every ton of metals and other raw materials consumed

by its advanced $5 trillion industrial economy.

Yet thanks to the mad money printer who Prime Minister Abe seconded

to the BOJ, Hiroki Kuroda, import prices are up by a staggering 30%

since 2012. Even with oil prices now collapsing, the yen price of crude

oil imports is still higher than it was two years back. Not

surprisingly, input costs for Japan’s legions of small businesses have

soared, and the cost of living faced by its legendary salary men has

risen far faster than wages.

Accordingly, domestic businesses that supply the home market—and that

is the overwhelming share of Japan’s output—are being driven to the

wall, bankruptcies are at record highs and the real incomes of Japan’s

households have now shrunk for 16 consecutive months and are down by 6%

compared to 2 years ago. And the purpose of all this punishment?

Well, its something right out of the Keynesian “Sesame Street”. We

are talking here about our friend the letter “J” that was scribbled on a

napkin in Cambridge MA more than a half-century ago. That is to say,

when you trash your currency your trade balance is supposed to get worse

for a while, and then it gets all better. Hence, the “J-curve”.

Needless to say, its not working for Japan. The fact is, Japan is an

old age colony that is in debt up to the eyeballs of what will soon be a

retirement population larger than its work force. So it desperately

needs to run a trade balance—and better still, a surplus—-with the rest

of the world in order to accumulate acorns for its long time future as

an economic rest home.

As shown below, however, Abenomics has had the very opposite effect.

Japan’s normal moderate surplus since its 1990 crisis has plunged into

deep red ink since the onset of Abenomics. Stated differently, Seasame

Street economics has been an unmitigated disaster for Japan.

The idea of the J-Curve and getting richer by getting poorer is

nonsense anyway. But when you apply this misbegotten Keynesian dogma to a

unique economy that is essentially a one-of-a-kind materials conversion

machine, which transforms raw resources from the rest of the planet

into advanced industrial, consumer and technology goods, you are

essentially committing economic hari kari.

Even before taking into account the potential for trade and

currency retaliation owing to this blatant beggar-the-neighbor policy,

Japan will never get off the bottom of its J-Curve because is inherently

a big importer. And unlike Germany, for example, where exports amount

to 40% of GDP, Japan’s exports now average less than 12%.

So in terms of the Keynesian preoccupation with “flow” (that is,

current period income and outgo), here is what you have on the trade

front. Exports have risen barely 18% in yen terms and not at all in

physical quantity. By contrast, imports are up 35% in yen terms—-not

because Japan Inc is thriving, but because the BOJ has flooded the world

with yen that nobody wants.

But the “nobody wants” part is the heart of the matter. Keynesian

economic models have no balance sheet concept, and therefore its high

priests roam the world preaching the same one-size-saves-all dogma to

governmental congregations, whether they are flush with cash or are

buried in debt. But that is just plain stupid when it comes to today’s

monumental debtors.

The latter desperately need to reduce their consumption and increase

their savings—–especially if they are rapidly getting old

demographically and need to build their individual and collective nest

eggs. Needless to say, the BOJ’s vicious assault on savers makes the Fed

look like a model of decorum.

Forget the overnight rate, which is ZIRP on most of the planet. In

Japan, 10-year money on the supposed risk-free JGB is now exactly

0.398%.

Consequently, there is not a single sentient buyer for Japan’s monumental government debt left anywhere in the known universe. Germans

and Martians, who count their wealth in something other than yen, are

most certainly not going to buy bonds denominated in a vanishing

exchange rate.

The same story holds domestically. The long suffering Japanese banks

are getting out of government bonds, and not just because the MOF and

BOJ are telling them to. Indeed, along with the life insurance

companies, other institutional investors and even the proverbial Mrs.

Watanabe of the household sector, they are getting out of JGBs because

Kuroda and Abe are making them a proposition they can’t refuse. Namely,

these madmen through the open market desk at the BOJ are “bid” any and

all bonds on offer; and at nose-bleed prices (that is, the inverse of

the 0.398% yield) that vastly exceed the true economic value of debt

that one day the Japanese government must and will default on.

In other words, blindly following the Keynesian dogma that has been

impressed upon them by the IMF economists, the G-7 and G-20

apparatchiks, and the parade of itinerant snake oil salesman like

Krugman, Bernanke, and Larry Summers, the BOJ has become some kind of

infernal vacuum cleaner that intends to suck-up every last bond the

bankrupt Japanese government can issue. And as a reminder, that is

already a financial Mt. Fuji and then some.

Needless to say, bidding the entire world out of its JGBs creates two

gargantuan problems. In the case of domestic investors, what do they do

with the cash? Well, in the paradigm of Keynesian central bankers the

world over—they, perforce, put it in “risk assets”.

And that brings us back to Mr.Takahiro Mitani——the man with utmost

confidence that Japan’s economic future is bright and the nominal head

of Japan’s giant $1.4 trillion Government Pension Investment Fund

(GPIF). But let’s state that more plainly. Mitani is the utterly naïve

and clueless long-time BOJ-GPIF financial bureaucrat who has been

ordered by Abe to flush the GPIF of upwards of $400 billion of

government bonds which it has held for years, and upon which it has

earned virtually nothing, in favor of buying the Japanese stock market

and a global equity basket, too.

Stated differently, these Keynesian preachers like Summers and

Krugman, who have the government of Japan in their thrall, are downright

cruel and malevolent. One of the few things that can

keep Japan’s projected 35 million retirees from resort to cat food

someday is their $1.4 trillion GPIF nest egg.

But under the influence of these financial terrorists—–and there is

no other way to describe them—– the government of Japan has ordered that

a huge chunk of that nest egg be put four-square in harm’s way. That

is, be invested at the tippy top of the greatest stock market bubble the

world has every seen.

Upwards of 40% of the fund is to go into equities and other

alternative assets and two-thirds of that is earmarked for Japanese

equities. So it is no wonder Mr. Mitani is whistling a happy tune about

Abenomics. He has no choice. After all, he has been “invited” to put

hundreds of billions into the Japanese stock market after it has doubled

in response to an economic program that amounts to a suicide mission.

This is where Keynesian dogma has taken Japan—–it has turned its

vaunted elite bureaucracy and historic governing class into a pathetic

band of financial lemmings. In particular, the GPIF desperately needs to

earn a robust return now before the real demographic tsunami hits.

That is, before its current 80 million strong work force shrinks to just

40 million over the next 50 years, while its army of retirees swells

from 25% to more than 40% of its population over the period.

But its central bank is now all-in for Keynesian money printing ,and

has thereby vaporized any yield at all in the fixed income market; and

has also knowingly or not, invited all the fast money punters of Wall

Street, London and the rest of the world to front-run an insane Tokyo

stock market bubble—–confident that at the first sign of trouble they

can drop their inflated shares on the retirement population of Japan.

Calling that scenario a reverse Pearl Harbor would be only a mild

resort to metaphor. Yet “Pearl Harbor” is the right metaphor because it

is forever connected with the brutal war which raged across the length

and breadth of East Asia thereafter.

This time it will be a currency war, but no less devastating for all

parties involved. The yen FX rate is currently in a temporary holding

pattern around 120, but just wait for the up-coming snap election and

the likelihood that the Japanese people will follow its lemming leaders

toward the terrible cliff of Abenomics.

But upon news of Prime Minister Abe’s electoral “mandate” to plow

full stream ahead, the Yen will plunge through 120 in an instant, and be

well on its way to 140 and not so far down the road to 200. But as

George H.W Bush said in another context—- and not the one which brought

him to the feet of Prime Minister Miyazawa in 1992—–the upcoming cliff

dive of the Japanese yen “cannot stand”. It will amount to thundering

frontal assault on the export mercantilism on which the entire bloated

edifice of China and the rest of East Asia is built.

One thing is certain about the ensuing “race to the bottom”. Japan’s retirement colony will end up with the hindmost.

And they will surely burn professors Krugman and Summers in effigy—-even if driftwood is the only fuel they have left.

Ah yes, the title. We weren’t kidding. As of this moment, Japan’s

misery has not been higher in an entire generation! Its Misery

index

that is, which combines unemployment (3.6%) and inflation (3.4%), and

results in an unprecedented 7.0%: the highest in 33 years!

To be sure, we warned explicitly about Japan’s soaring food prices. And now, here they are

Ah yes, the title. We weren’t kidding. As of this moment, Japan’s

misery has not been higher in an entire generation! Its Misery

index

that is, which combines unemployment (3.6%) and inflation (3.4%), and

results in an unprecedented 7.0%: the highest in 33 years!

To be sure, we warned explicitly about Japan’s soaring food prices. And now, here they are

By Eleanor Warnock And Kosaku Narioka at The Wall Street Journal

TOKYO—Japan’s $1.1 trillion government pension fund is betting that a

long-term recovery and rising corporate profits will push Tokyo stock

prices higher, helping the fund increase returns for the nation’s

retirees.

The Government Pension Investment Fund, the world’s largest of its

kind, is perhaps the most deep-pocketed investor betting that Prime

Minister Shinzo Abe ’s administration will end 15 years of deflation and

revitalize the country’s economy.

“I have no doubt that the economy is in a recovery trend if you look

at the long run,” GPIF President Takahiro Mitani said in an interview

Friday.

Expectations that Mr. Abe’s policies will succeed have already helped double Japan’s benchmark stock index since late 2012.

Further gains would no doubt benefit GPIF’s ¥23.9 trillion ($202 billion) domestic stock portfolio.

Mr. Abe has pushed for the fund to become a more aggressive and

sophisticated investor. The fund decided in October to shift its

portfolio to seek higher returns, slashing its target allocation to

domestic bonds almost in half while nearly doubling that of domestic and

foreign equities.

Mr. Mitani said the fund is still in the process of carrying out the

changes and has a long way to go. Just under 50% of its total portfolio

was in domestic bonds at the end of September, compared with its new

target of 35%.

He declined to say whether it had already bought more stocks and foreign bonds. “I leave it up to you to imagine that,” he said.

The GPIF will further discuss possible asset sales and purchases when

its new investment committee meets in January. Mr. Mitani said he and

GPIF’s new chief investment officer, who will join the fund the same

month, will both sit on the committee. Meanwhile, the fund is seeking

other members, and Mr. Mitani said he would welcome “a full-time member

who had some asset management expertise.”

Currently, the GPIF’s only investment committee is one staffed by

outside economic experts and academics that meets roughly once a month

to advise the president.

Shifting its portfolio will require the GPIF tell some fund managers

to sell, while giving others more money to invest. Mr. Mitani said he

would consider giving some firms the choice of investing in both

domestic and foreign stocks, something the fund hasn’t done.

In the future, GPIF also might consider changing its policy on

exposure to foreign currencies to allow hedging against currency risk.

Some lawmakers have argued that the GPIF law should be changed to let

the fund invest directly, yet Mr. Mitani said direct investment

probably wouldn’t be feasible. He envisioned that the fund would join

other institutional investors to invest in private equity or real

estate.

The GPIF manages reserves for the nation’s universal pension fund and

private companies’ plans. The fund is the rough equivalent of the U.S.

Social Security trust funds; the difference is that the GPIF invests in

listed securities.

Write to Eleanor Warnock at

eleanor.warnock@wsj.com and Kosaku Narioka at

kosaku.narioka@wsj.com

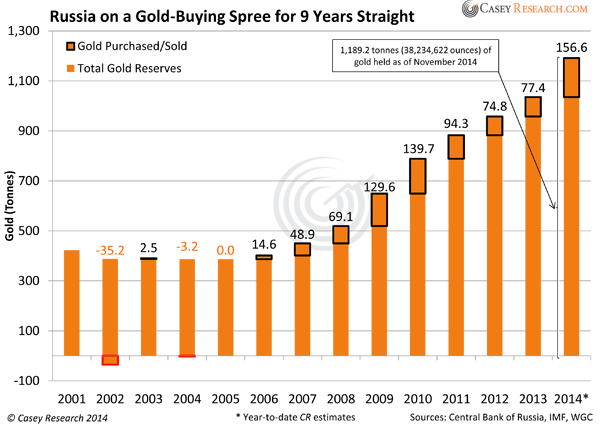

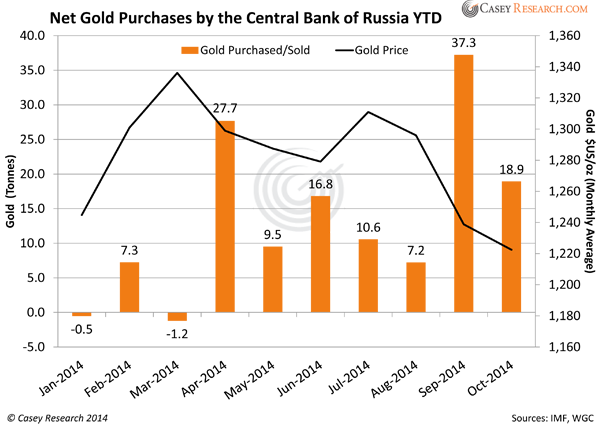

Why Russia And China Are Buying Gold, According To An Economics...

Why Russia And China Are Buying Gold, According To An Economics...