Monday, March 16, 2015

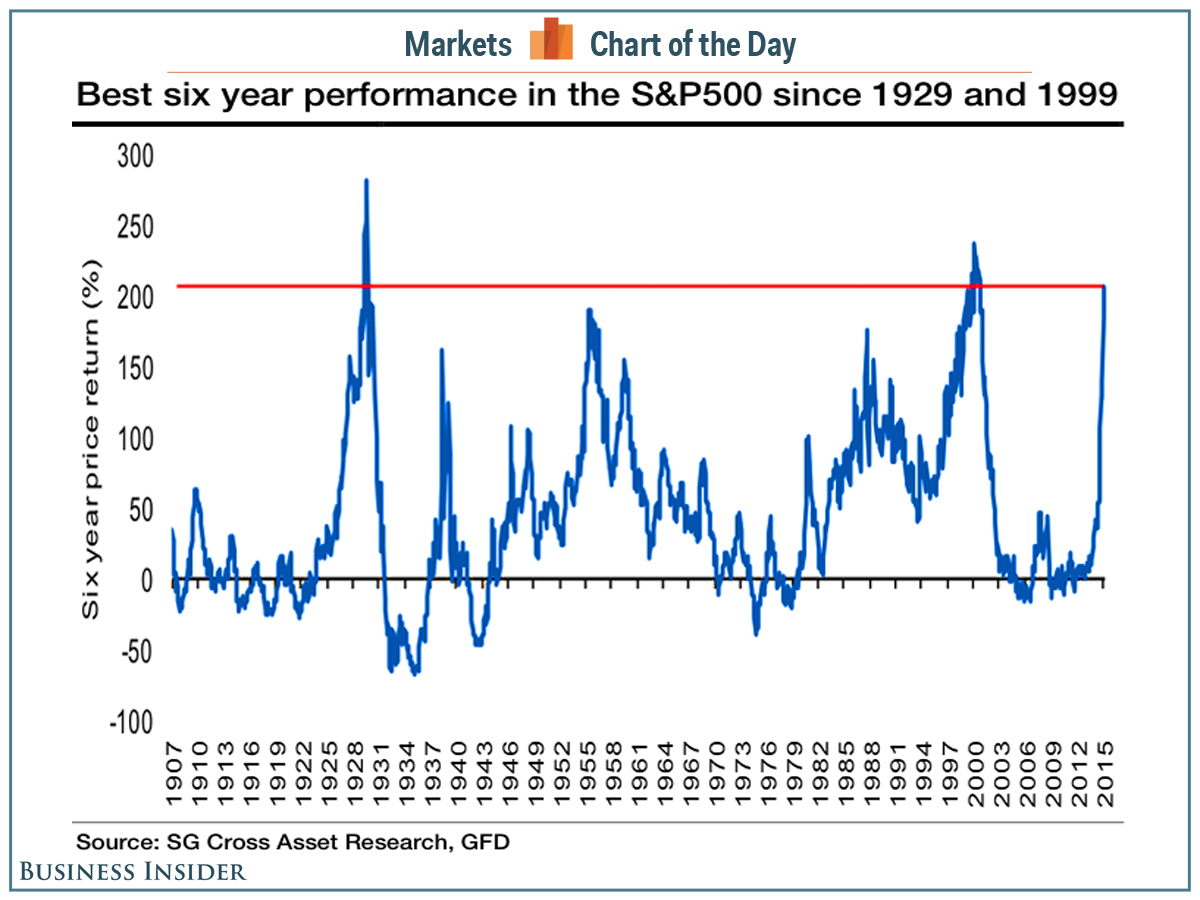

The stock market has gone up this far, this fast only twice since 1900

The stock market has gone up this far, this fast only twice since 1900 http://read.bi/1FM2AwQ

“Margin Call from Hell”: Why a Stronger Dollar will Lead to Deflation, Recession and Crisis

“Margin Call from Hell”

Why a Stronger Dollar will Lead to Deflation, Recession and Crisis

By Mike Whitney

“There are no nations…. no peoples…. no Russians.. no Arabs…no third worlds…no West. There is only one holistic system of systems, one vast and immane, interwoven, interacting, multi-variate, multi-national dominion of dollars. Petro-dollars, electro-dollars, multi-dollars, reichmarks, rins, rubles, pounds, and shekels. It is the international system of currency which determines the totality of life on this planet. That is the natural order of things today.”

“There is the risk for a sell-off in emerging market bonds, leading to conditions like in 1997. The multitrillion dollar carry trade may be on the verge of unwinding, meaning capital fleeing the periphery and rushing back to the US. Vast amounts of capital are already leaving some of these countries, and the secondary market for emerging bonds is beginning to dry up. A rise in US interest rates would only put oil on the fire.

http://smirkingchimp.com/thread/mike-whitney/61381/margin-call-from-hell-why-a-stronger-dollar-will-lead-to-deflation-recession-and-crisis

A strong dollar is NOT good for the economy, job creation, raising incomes, and — most importantly — America’s debt.

October always seems to be a bad month. And this go-round has been particularly troublesome because of all the uproar globally.

The market as a whole is wildly uncertain as to what that means and what impact it will have on global bond and equity markets when the Fed is out of the bond-manipulation business. Investors are trying to front-run a future that they expect will not be good for stocks, commodities, gold or currencies other than the dollar.

As emotion takes the reins, market volatility races higher …

Wall Street has grown fearful and anxious in regards to Yellen and her Fed these days. Investors haven’t a clue what the Fed is really up to … because the Fed itself seems a bit clueless in its directions and commentary. And the Street reflexively understands that the Fed has itself in a nasty pickle:

Why a Stronger Dollar will Lead to Deflation, Recession and Crisis

By Mike Whitney

“There are no nations…. no peoples…. no Russians.. no Arabs…no third worlds…no West. There is only one holistic system of systems, one vast and immane, interwoven, interacting, multi-variate, multi-national dominion of dollars. Petro-dollars, electro-dollars, multi-dollars, reichmarks, rins, rubles, pounds, and shekels. It is the international system of currency which determines the totality of life on this planet. That is the natural order of things today.”

– Arthur Jensen’s speech from Network, a 1976 American satirical film written by Paddy Chayefsky and directed by Sidney Lumet

March 14, 2015 “ICH” – “Counterpunch” – The crisis that began seven

years ago with easy lending and subprime mortgages, has entered its

final phase, a currency war between the world’s leading economies each

employing the same accommodative monetary policies that have intensified

market volatility, increased deflationary pressures, and set the stage

for another tumultuous crack-up. The rising dollar, which has soared to a

twelve year high against the euro, has sent US stock indices plunging

as investors expect leaner corporate earnings, tighter credit, and

weaker exports in the year ahead. The stronger buck is also wreaking

havoc on emerging markets that are on the hook for $5.7 trillion in

dollar-backed liabilities. While most of this debt is held by the

private sector in the form of corporate bonds, the stronger dollar means

that debt servicing will increase, defaults will spike, and capital

flight will accelerate. Author’s Michele Brand and Remy Herrera summed

it up in a recent article on Counterpunch titled “Dollar Imperialism,

2015 edition”. Here’s an excerpt from the article:“There is the risk for a sell-off in emerging market bonds, leading to conditions like in 1997. The multitrillion dollar carry trade may be on the verge of unwinding, meaning capital fleeing the periphery and rushing back to the US. Vast amounts of capital are already leaving some of these countries, and the secondary market for emerging bonds is beginning to dry up. A rise in US interest rates would only put oil on the fire.

http://smirkingchimp.com/thread/mike-whitney/61381/margin-call-from-hell-why-a-stronger-dollar-will-lead-to-deflation-recession-and-crisis

A strong dollar is NOT good for the economy, job creation, raising incomes, and — most importantly — America’s debt.

October always seems to be a bad month. And this go-round has been particularly troublesome because of all the uproar globally.

We have Ebola in America freaking out the natives (not to mention investors).

We have the sanctions in Europe and Russia undermining the European

economies. And we have double trouble in the oil markets: the Saudis are

manipulating the price to run high-cost American and Canadian producers

out of the market, while at the same time a robust dollar is reducing

oil demand globally.

And at the pinnacle of this pyramid of problems sits our Federal Reserve.

This month, it has promised, it will end its Quantitative Easing (QE)

campaign and begin moving toward normalized interest rates.The market as a whole is wildly uncertain as to what that means and what impact it will have on global bond and equity markets when the Fed is out of the bond-manipulation business. Investors are trying to front-run a future that they expect will not be good for stocks, commodities, gold or currencies other than the dollar.

As emotion takes the reins, market volatility races higher …

Wall Street has grown fearful and anxious in regards to Yellen and her Fed these days. Investors haven’t a clue what the Fed is really up to … because the Fed itself seems a bit clueless in its directions and commentary. And the Street reflexively understands that the Fed has itself in a nasty pickle:

- The Fed has said it will begin raising interest rates, possibly within six months of ending the QE program, which would imply spring … yet the euro zone is pushing rates down in Europe. That means interest rates on the dollar and the euro will be moving in opposite directions … which means money coming out of the euro and into the dollar, resulting in a stronger dollar. That’s not good, because …

- The Fed needs a stronger economy to create jobs and, the Fed hopes, inflation that then flows through to higher personal incomes that have been on the decline for the better part of a decade. Yet a stronger dollar works to undermine that need, since a strong dollar curtails export activity, thereby slowing the U.S. economy. Meanwhile …

- The Fed has to balance higher rates with America’s horrific levels of debt. As rates rise, so do interest payments on our debt … which either impacts Congress’ ability to fund the various programs it needs to fund, or it requires America to borrow even more money to cover the higher interest payments, throwing us into the early stages of a deadly debt vortex.

Fed governors, thus, are walking a tightrope as

thin as floss, and investors are expressing their panic by fleeing all

assets but the dollar.

http://thesovereigninvestor.com/economic-collapse-2/global-economy-anticipates-fed-next-move/?utm_content=buffer54da1&utm_medium=social&utm_source=twitter.com&utm_campaign=bufferNomi Prins – People Don’t Have Any Money, When Artificial Debt Buying Stops Things Will Apart

So, is anything in

the financial sector actually fixed? Former top Wall Street banker Nomi

Prins contends, “We have many trillions of dollars and government policy

trying to basically cover up the holes in the entire financial system

that could create another Lehman or multiple Lehmans. So, we have a

white wash or a hole in the wall that’s been plastered over many, many,

many times. The hole is still there. The danger is still there. The

co-dependency is still there. The leverage is still there. . . .It all

look like there has been this cosmetic shift supporting these banking

institutions rather than supporting, from the bottom up, the economies

of these countries. That has the effect of creating deterioration in any

of the assets that these banks are still financing. . . . “Buying

securities does not help people get jobs. It does not help industries to

continue to innovate. It does absolutely nothing for spreading a

foundation of solid economics throughout the population. All it does is

make banks look better and cover these holes. Even with all that, holes

continue to pop up and be visible, and that indicates a much larger

problem. . . . People don’t have money. Even if the headline

unemployment looks good, the reality is the jobs being created do not

pay well. So, people don’t have any money.”

In closing, Prins paints a grim picture by saying, “When there is no

artificial external buyer for debt, that’s when things will fall apart.”Join Greg Hunter as he goes One-on-One with Nomi Prins, best-selling author of “All the Presidents’ Bankers.”

http://usawatchdog.com/when-artificia…

The World’s Largest Derivative Holder…Just Failed the Stress Test

The US Federal Reserve has slammed the

breaks on the German bank’s plans to raise dividends and buy back

shares. The central bank says its US operations are too weak to survive

another major economic crisis.

Fed tells Deutsche Bank US to reduce risk

The US divisions of Germany’s biggest bank failed a crucial stress test on Wednesday after the Federal Reserve in Washington deemed its financial foundation too weak to withstand a crisis like the one that threatened to crash the global economy in 2008.

The Fed faulted the capital plans of some 12 to 14 percent of Deutsche Bank’s US operations, saying they showed “numerous and significant deficiencies.”

For the second year in a row, the central bank also vetoed the US plans of Spain’s largest bank, Santander, pointing to “widespread and critical deficiencies” with regard to governance, planning for risks and other areas.

Santander and Deutsche Bank have $118 billion (111.1 billion euros) and $55 billion in assets in the US respectively.

Deutsche Bank offensive

For Deutsche Bank, it was the first US stress test since the Fed launched its review in 2009.

Reacting to the Fed’s objections, a Deutsche Bank spokeswoman in New York said the company had already recruited 500 employees and launched an investment offensive to the tune of 1 billion euros ($1.06 billion) meant to improve the shortcomings.

The Elephant In The Room: Deutsche Bank’s $75 Trillion In Derivatives Is 20 Times Greater Than German GDP

It is perhaps supremely ironic that the last time we did an in depth analysis of Deutsche Bank’s financial situation was precisely a year ago, when the largest bank in Europe (and according to some, the world), stunned its investors with a 10% equity dilution. Why the capital raise if everything was as peachy as the ECB promised it had been? It turned out, nothing was peachy, and in fact DB would proceed to undergo a massive balance sheet deleveraging campaign over the next year, in which it would quietly dispose of all the ugly stuff on its balance sheet during the relentless Fed and BOJ-inspired “dash for trash” rally in a way not to spook investors about everything else that may be beneath the Deutsche covers.

We note this because moments ago, Deutsche Bank did the same again when it announced that it would issue yet another €1.5 billion in Tier 1 capital.

http://www.zerohedge.com/news/2014-04-28/elephant-room-deutsche-banks-75-trillion-derivatives-20-times-greater-german-gdp

Fed tells Deutsche Bank US to reduce risk

The US divisions of Germany’s biggest bank failed a crucial stress test on Wednesday after the Federal Reserve in Washington deemed its financial foundation too weak to withstand a crisis like the one that threatened to crash the global economy in 2008.

The Fed faulted the capital plans of some 12 to 14 percent of Deutsche Bank’s US operations, saying they showed “numerous and significant deficiencies.”

For the second year in a row, the central bank also vetoed the US plans of Spain’s largest bank, Santander, pointing to “widespread and critical deficiencies” with regard to governance, planning for risks and other areas.

Santander and Deutsche Bank have $118 billion (111.1 billion euros) and $55 billion in assets in the US respectively.

Deutsche Bank offensive

For Deutsche Bank, it was the first US stress test since the Fed launched its review in 2009.

Reacting to the Fed’s objections, a Deutsche Bank spokeswoman in New York said the company had already recruited 500 employees and launched an investment offensive to the tune of 1 billion euros ($1.06 billion) meant to improve the shortcomings.

The Elephant In The Room: Deutsche Bank’s $75 Trillion In Derivatives Is 20 Times Greater Than German GDP

It is perhaps supremely ironic that the last time we did an in depth analysis of Deutsche Bank’s financial situation was precisely a year ago, when the largest bank in Europe (and according to some, the world), stunned its investors with a 10% equity dilution. Why the capital raise if everything was as peachy as the ECB promised it had been? It turned out, nothing was peachy, and in fact DB would proceed to undergo a massive balance sheet deleveraging campaign over the next year, in which it would quietly dispose of all the ugly stuff on its balance sheet during the relentless Fed and BOJ-inspired “dash for trash” rally in a way not to spook investors about everything else that may be beneath the Deutsche covers.

We note this because moments ago, Deutsche Bank did the same again when it announced that it would issue yet another €1.5 billion in Tier 1 capital.

http://www.zerohedge.com/news/2014-04-28/elephant-room-deutsche-banks-75-trillion-derivatives-20-times-greater-german-gdp

Jim Willie: Swiss De-peg Triggers Massive Derivative Crisis, Potential END OF THE EURO!

Big Banks and Derivatives: Why Another Financial Crisis Is Inevitable

http://www.forbes.com/sites/stevedenning/2013/01/08/five-years-after-the-financial-meltdown-the-water-is-still-full-of-big-sharks/Derivatives contributed to the Economic Crisis

http://www.wapublicbankproject.org/index.php?option=com_content&view=article&id=50&Itemid=60

uncle

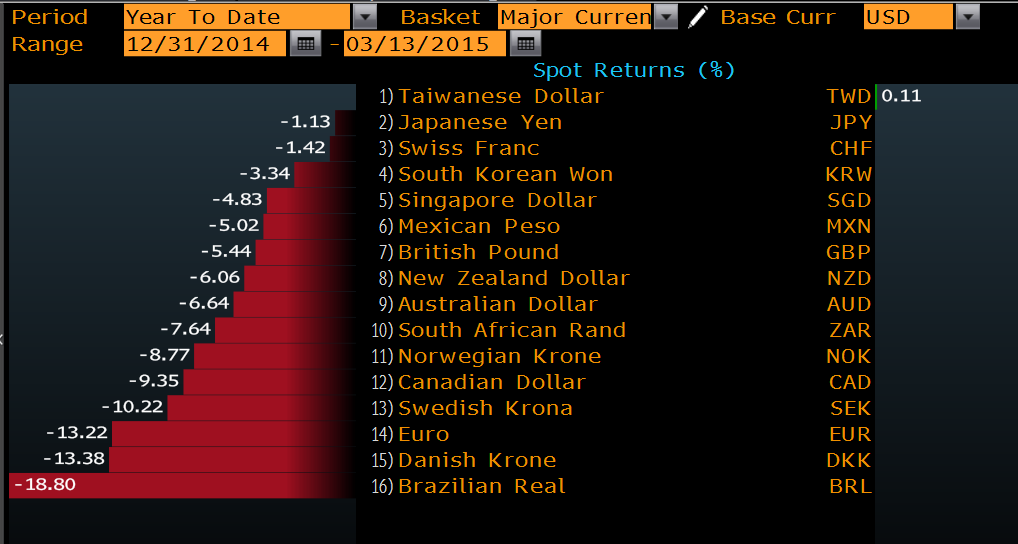

Most currencies are taking a drubbing against the almighty Fed-might-tighten U.S. dollar

Most currencies are taking a drubbing against the almighty Fed-might-tighten U.S. dollar http://bloom.bg/1Be5Yw1

What do the Malawian kwacha, the Somali shilling, the Seychelles rupee, and the Costa Rican colon have in common?

They are the only currencies in the world that are more than 1 percent higher against the U.S. dollar so far this year.

http://www.bloomberg.com/news/articles/2015-03-13/how-a-bunch-of-different-currencies-are-doing-against-the-dollar-this-year

The Austrian Black Swan Claims Its First Foreign Casualty: German Duesselhyp Collapses, To Be Bailed Out

Precisely one week ago in "A Black Swan Lands In Southern Austria: The Ripple Effects Of "Mini-Greece Going Off In The Heartland Of Europe",

when analyzing the consequences of the collapse of Austria's bad bank,

we noted perhaps the biggest paradox of Europe's emergency preparedness

response to the Greek collapse and imminent expulsion from the Eurozone:

namely that the biggest threat to German banks was no longer in some

Mediterranean nation, but in its very own back yard. To wit:

And while in the US FDIC Failure Fridays works like a well-greased machine, Germany has yet to get the hang of the whole "save the bad news for Friday after market close" thing and has for now has stopped on "Shocker Sundays."

Then again, this being Europe, denial persists even after the moment of failure, and according to Reuters, "the German banking association BdB, which runs the fund, is, however, not planning to wind down the bank, but wants to continue its operations."

As for the biggest winner from today's surprise announcement, London-based Attestor which until this moment was supposed to buy the German bank. Talk about saved by the "bank failure"... and due diligence.

Because if a 1.5% write down in the assets of a supposedly well-capitalized German bank can lead to almost overnight insolvency, one can almost imagine what will happen when the Austrian black swan wave reaches Europe's actually "undercapitalized" banks...

Indeed, it was just the beginning, and moments ago we got confirmation that the next domino has tipped over, following a Reuters report that Germany's deposit protection fund will take over the property lender Duesseldorfer Hypothekenbank AG (DuesselHyp), which has "run into problems" due to its exposure to Austrian lender Hypo Alpe Adria's "bad bank" Heta.Irony #2, and the biggest one of all: while German banks had spent the past 3 years preparing for the inevitable Grexit and offloading all their exposure to the now insolvent Greek state, it was a waterfall chain of events which started in Germany's own "back yard", courtesy of auditors who decided it was unnecessary to mark losses to market until it was far too late, and the immediate outcome is that one ninth of until recently Aaa/AAA-rated Austria is now also insolvent. And that is just the beginning.

One can only imagine how many such other "0% risk-weighted" Pandora boxes lie in wait across what are otherwise considered Europe's safest banks, provinces and nations.

And while in the US FDIC Failure Fridays works like a well-greased machine, Germany has yet to get the hang of the whole "save the bad news for Friday after market close" thing and has for now has stopped on "Shocker Sundays."

Then again, this being Europe, denial persists even after the moment of failure, and according to Reuters, "the German banking association BdB, which runs the fund, is, however, not planning to wind down the bank, but wants to continue its operations."

We described the consequences from the Heta fallout in minute detail last week, but for those who missed it, here are the Cliff notes:"The deposit protection fund is granting a guarantee for the Heta bonds to eliminate the immediate risks. The goal is a complete takeover of Duesseldorfer Hypothekenbank," the BdB said in a statement on Sunday.

So a partial impairment on $365 million in debt is enough to send a German bank, which according to its latest interim financial report, had €10.9 billion in assets, into full out insolvency? As if the ECB's farcical stress tests needed any further validation they are nothing but the worst possible joke on Europe's depositors Goldman's head of the ECB could have conceived.Regulators this month took control of Heta and imposed a debt moratorium until May 2016 after an outside audit found writedown needs that blew a hole of up to 7.6 billion euros in its balance sheet. This leaves holders of Heta debt in limbo and facing the prospect of losses.

Heta could still be declared insolvent despite plans to wind it down, the Austrian regulator FMA has said, a move that could hit German banks harder than many of their Austrian rivals.

After regulators took control of Heta, the ratings agency Fitch said last week that DuesselHyp was in urgent need of capital support.

In its 2013 annual report, DuesselHyp said it had 348 million euros ($365 million) in Hypo Alpe Adria debt.

As for the biggest winner from today's surprise announcement, London-based Attestor which until this moment was supposed to buy the German bank. Talk about saved by the "bank failure"... and due diligence.

One can almost see why. As for the guy who looked at DuesselHyp's balance sheet and "wisely" concluded it is worth X, good luck finding a job. Don't worry though, many more "analysts" at other banks will be joining you in the unemployment line as more European banks admit they are insolvent when a world that is "priced to perfection" is revealed to have been anything but.The planned takeover by the BdB also means that a planned sale of DuesselHyp to group of international buyers led by London-based Attestor is no longer being considered, a source familiar with the situation said.

Because if a 1.5% write down in the assets of a supposedly well-capitalized German bank can lead to almost overnight insolvency, one can almost imagine what will happen when the Austrian black swan wave reaches Europe's actually "undercapitalized" banks...

Household Debt Soars in Canada, “Stability” at Risk

Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

Debt by Canadian households is a special phenomenon. Statistics Canada reported today that in the fourth quarter, household debt set another breath-taking record.

Earlier this month, even Equifax Canada, which is in the business of facilitating and increasing this indebtedness, had warned about it. The total indebtedness of Canadian households, according to its own measure, had jumped 7.7% from prior year, which had already been at record levels. The biggest culprits were installment and auto loans. Households are powering consumer spending, and thus the overall economy, with ever larger amounts of ultimately unsustainable debt.

Now Statistics Canada weighed in. In Q4, household borrowing, on a seasonally adjusted basis, jumped by C$22.6 billion from the third quarter. Credit cards and auto loans accounted “for the majority of the overall increase.” Total household debt (consumer credit, mortgage, and non-mortgage loans) rose 1.1% from the prior quarter to C$1.825 trillion, with consumer credit hitting $519 billion and mortgage debt C$1.184 trillion.

And how did that impact households?

image: http://wolfstreet.com/wp-content/uploads/2015/03/Canada-household-leverage-indicators-1992-2014_Q4.png

And if interest rates ever rise even by a smidgen? The blue line would do what it started doing in 2006. It would roar higher. With consumer indebtedness at these levels, even a small increase in interest rates will make a big difference in the interest expense consumers would have to fork over.

The Bank of Canada – kicked into panic mode by the collapse of oil prices, the faltering housing market, vulnerable banks, and other nagging issues, including the indebtedness of the consumer, which it pointed out as a risk factor last year – suddenly cut its benchmark interest rate in January. In the past, it communicated such moves in advance. In January, it was a surprise move that shocked the markets.

Today, Rhys Mendes, Deputy Chief of the Bank of Canada’s Economic Analysis Department, told the House of Commons finance committee that the central bank would “not necessarily” be pressured into following the Fed’s rate increases this year. “The bank targets inflation in Canada, and decisions regarding monetary policy in Canada would be based on the outlook for inflation,” he said, presenting the central-bank smokescreen for keeping rates at near zero for other reasons.

The Bank of Canada will have trouble ever raising rates, regardless of the distortion and mayhem near-zero rates are causing. Households can no longer afford higher rates. They have too much debt and not enough income. Higher interest payments would eat into spending on other things. Higher mortgage rates would crash the still magnificent home prices. Consumers would buckle under their burden and default. Not to speak of the already struggling oil companies. And then there are the banks that have lent with utter abandon to all of them.

Years of low interest rates encouraged this dreadful level of leverage. Now it’s an albatross around the neck of the Bank of Canada, and for decades to come. And for the economy, it’s a high-risk burden that could quickly, as Equifax suggested, blow up.

Debt by Canadian households is a special phenomenon. Statistics Canada reported today that in the fourth quarter, household debt set another breath-taking record.

Earlier this month, even Equifax Canada, which is in the business of facilitating and increasing this indebtedness, had warned about it. The total indebtedness of Canadian households, according to its own measure, had jumped 7.7% from prior year, which had already been at record levels. The biggest culprits were installment and auto loans. Households are powering consumer spending, and thus the overall economy, with ever larger amounts of ultimately unsustainable debt.

A “a cautionary tale,” the report called it.

The rapid decline in oil prices caught many by surprise. And, that’s the point – consumers and business owners need to be more vigilant. When economic change happens, it can happen very quickly and can challenge previously observed stability of key economic and credit indicators.In other words, as the price of oil collapsed, as housing stumbled, and as layoffs began – the “economic change” that “can happen very quickly” – the “stability” of different aspects of the economy, including household debt, is suddenly at risk. It’s a warning that consumers might buckle under that mountain of debt.

Now Statistics Canada weighed in. In Q4, household borrowing, on a seasonally adjusted basis, jumped by C$22.6 billion from the third quarter. Credit cards and auto loans accounted “for the majority of the overall increase.” Total household debt (consumer credit, mortgage, and non-mortgage loans) rose 1.1% from the prior quarter to C$1.825 trillion, with consumer credit hitting $519 billion and mortgage debt C$1.184 trillion.

And how did that impact households?

For the third consecutive quarter, disposable income increased at a slower rate than household credit market debt. As a result, leverage, as measured by household credit market debt to disposable income, reached a new high of 163.3% in the fourth quarter. In other words, households held roughly $1.63 of credit market debt for every dollar of disposable income in the fourth quarter.

For the moment, there is still one saving grace to

this rising mountain of debt: interest rates have been coming down for

years. So the debt service ratio, which measures household interest

expense as a proportion of disable income, has been declining as a

function of interest rates, though it inched up in Q4 to 6.8%

The chart shows how the ratio of debt to disposable income (red line,

left scale) has been rising with a few exceptions, while the debt

service ratio (blue line, right scale) has followed interest rates up

and down:image: http://wolfstreet.com/wp-content/uploads/2015/03/Canada-household-leverage-indicators-1992-2014_Q4.png

The ratio of debt to disposable income picked up

speed from 2001 on. It blew through the financial crisis even as US

households were whittling down their debt by deleveraging and

defaulting. Canadian households didn’t even stop to breathe. They kept

spending and piled on debt at an astounding rate. Their incomes rose

also, but not nearly enough. It wasn’t until 2011 that the red-hot

growth rate started to lose some of its fire, bumping into all sorts of

resistance from reality.

With interest rates getting pushed lower year after year, interest

expense as a percent of disposable income – the debt to service ratio –

has been declining. For the moment, these low interest rates keep the

whole thing glued together.And if interest rates ever rise even by a smidgen? The blue line would do what it started doing in 2006. It would roar higher. With consumer indebtedness at these levels, even a small increase in interest rates will make a big difference in the interest expense consumers would have to fork over.

The Bank of Canada – kicked into panic mode by the collapse of oil prices, the faltering housing market, vulnerable banks, and other nagging issues, including the indebtedness of the consumer, which it pointed out as a risk factor last year – suddenly cut its benchmark interest rate in January. In the past, it communicated such moves in advance. In January, it was a surprise move that shocked the markets.

Today, Rhys Mendes, Deputy Chief of the Bank of Canada’s Economic Analysis Department, told the House of Commons finance committee that the central bank would “not necessarily” be pressured into following the Fed’s rate increases this year. “The bank targets inflation in Canada, and decisions regarding monetary policy in Canada would be based on the outlook for inflation,” he said, presenting the central-bank smokescreen for keeping rates at near zero for other reasons.

The Bank of Canada will have trouble ever raising rates, regardless of the distortion and mayhem near-zero rates are causing. Households can no longer afford higher rates. They have too much debt and not enough income. Higher interest payments would eat into spending on other things. Higher mortgage rates would crash the still magnificent home prices. Consumers would buckle under their burden and default. Not to speak of the already struggling oil companies. And then there are the banks that have lent with utter abandon to all of them.

Years of low interest rates encouraged this dreadful level of leverage. Now it’s an albatross around the neck of the Bank of Canada, and for decades to come. And for the economy, it’s a high-risk burden that could quickly, as Equifax suggested, blow up.

Gravity is already and very inconveniently inserting itself into Canada’s incredible housing boom. Read… Housing Construction Skids in Canada, but Crashes in the Oil Patch

Debt-damned economics: either learn monetary reform, or kiss your assets goodbye (2 of 7)

The following is my high school teaching assignment for Advanced

Placement Macroeconomics students (available as extra credit for other

classes) on how money is created. I offer this for non-profit use;

divided into seven sections:

It’s time for you to learn.

I teach Advanced Placement (AP) Macroeconomics. The following is what I provide to students, AP colleagues, and non-controversial in its first four points of content. That is, there is zero disagreement among professionals in economics about factual accuracy.

And that said, although textbook economics provides the information of what we have as a monetary system, citizens need to take the last step to see for themselves what the private banks that own the Federal Reserve will never admit: their monetary system provides parasitic profits to leading Wall Street banks, bailouts in the trillions, and that an honest cost-benefit analysis proves their system should immediately be retired and replaced.

I assert the facts to prove this are obvious upon inspection, affirmed by many of America’s greatest historical figures beginning with Benjamin Franklin, and that those of us who present this argument are unaware of any refutation of our claims. Indeed, we welcome any attempt.

Because this information will likely be new to you (and to your parents), it may help to consider the paradox of learning history: every generation sees itself as “completely modern,” and that treachery such as an economic system parasitizing trillions from the public could not be possible in “modern times.” It’s easy to look back in history and see exactly such treachery, of course. It’s also easy to empathize with historical citizens who failed to recognize objective facts from “official propaganda.”

Need I say more…? A crucial lesson from history is appreciating the possibility that such treachery exists today, that “official propaganda” attempts to hide it, and as always, objective facts reveal what is actually happening. You’ve heard this quote; please allow it to resonate with you:

With hindsight, we all know that my great-grandfather was correct that people who read are indeed “just sitting there,” but we are far from “doing nothing.”

With a little curiosity, new worlds open for us. This topic you’re reading now, worth trillions of dollars, is arguably the most valuable investment of time you’ll ever make.

Before we begin exploring the mechanics of what we use for money, one more point:

Because people don’t know how money is created and managed, the only thing between them and tyrannical monetary policy is trust in ethical government. American democracy is founded upon cautious distrust of government. To compensate for temptations of power and personal profit in government, the US Constitution is designed with checks and balances. However, because checks and balances can be thwarted if politicians are unethical, the only real protection of liberty is citizen responsibility.

American democracy and freedom is dependent upon our taking personal responsibility for understanding our most important economic and political issues. This is one of them.

Endnote:

1 With greater context: Herman, C. Washington’s Blog. Federal Reserve, national debt nearly defeated during Great Depression; let’s finish the job. Feb. 8, 2012. http://www.washingtonsblog.com/2012/02/federal-reserve-national-debt-nearly-defeated-during-great-depression-lets-finish-the-job.html

- Instructions (1 of 7)

- Contextual orientation: seeing the past as clearly as possible (2 of 7)

- Money and bank credit (3 of 7)

- Fractional reserve banking (4 of 7)

- Debt (public, private) and money supply (5 of 7)

- Historical struggle between government-issued money and private bank-issued credit (6 of 7)

- Cost-benefit analysis for monetary reform in your world of the present (7 of 7)

1. Contextual orientation: seeing the past as clearly as possible

“All the perplexities, confusions, and distresses in America arise, not from defects in their constitution or confederation, not from a want of honor or virtue, so much as from downright ignorance of the nature of coin, credit, and circulation.” – John Adams, letter to Thomas Jefferson (1787-08-25), The Works of John AdamsWithout knowing how money is created and managed, all other topics concerning money are out of context. This is crucial: regarding trillions of dollars of economic power, you have no idea where money comes from.

“If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. We are completely dependent on the commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon.” - Robert H. Hemphill (1), Credit Manager of the Federal Reserve Bank of Atlanta, 1934 foreword to 100% Money, by Irving Fisher. Fisher was a Yale economist whose proposal for monetary reform lost to Keynes’ deficit spending plan during the Great Depression.

It’s time for you to learn.

I teach Advanced Placement (AP) Macroeconomics. The following is what I provide to students, AP colleagues, and non-controversial in its first four points of content. That is, there is zero disagreement among professionals in economics about factual accuracy.

And that said, although textbook economics provides the information of what we have as a monetary system, citizens need to take the last step to see for themselves what the private banks that own the Federal Reserve will never admit: their monetary system provides parasitic profits to leading Wall Street banks, bailouts in the trillions, and that an honest cost-benefit analysis proves their system should immediately be retired and replaced.

I assert the facts to prove this are obvious upon inspection, affirmed by many of America’s greatest historical figures beginning with Benjamin Franklin, and that those of us who present this argument are unaware of any refutation of our claims. Indeed, we welcome any attempt.

Because this information will likely be new to you (and to your parents), it may help to consider the paradox of learning history: every generation sees itself as “completely modern,” and that treachery such as an economic system parasitizing trillions from the public could not be possible in “modern times.” It’s easy to look back in history and see exactly such treachery, of course. It’s also easy to empathize with historical citizens who failed to recognize objective facts from “official propaganda.”

Need I say more…? A crucial lesson from history is appreciating the possibility that such treachery exists today, that “official propaganda” attempts to hide it, and as always, objective facts reveal what is actually happening. You’ve heard this quote; please allow it to resonate with you:

“Progress, far from consisting in change, depends on retentiveness. When change is absolute there remains no being to improve and no direction is set for possible improvement: and when experience is not retained, as among savages, infancy is perpetual. Those who cannot remember the past are condemned to repeat it.” – George Santayana, The Life of Reason, Vol. 1.And:

“There is nothing new in the world except the history you do not know.” - President Harry Truman, Plain Speaking: An Oral Biography of Harry S. Truman (1974) by Merle Miller, pg. 26.Let me tell you a story that might help: my grandfather (“Papa”) was born in 1891. He grew up on a farm, loved to read, and had a father who never read for pleasure. One day, Papa was hiding behind a stack of hay bales to read. Suddenly, his father appeared, hands on his hips, boring his eyes upon his son in disbelief, and said, “What are you doing? You’re just sitting there, doing nothing. Why aren’t you doing something?” Papa’s father believed himself to be a “modern man,” capable of understanding life’s most important ideas. He concluded that if there was an idea he didn’t already understand, it had to be without value. And importantly, it didn’t matter that the evidence was right in front of his own eyes; he couldn’t recognize what he couldn’t imagine.

With hindsight, we all know that my great-grandfather was correct that people who read are indeed “just sitting there,” but we are far from “doing nothing.”

With a little curiosity, new worlds open for us. This topic you’re reading now, worth trillions of dollars, is arguably the most valuable investment of time you’ll ever make.

Before we begin exploring the mechanics of what we use for money, one more point:

Because people don’t know how money is created and managed, the only thing between them and tyrannical monetary policy is trust in ethical government. American democracy is founded upon cautious distrust of government. To compensate for temptations of power and personal profit in government, the US Constitution is designed with checks and balances. However, because checks and balances can be thwarted if politicians are unethical, the only real protection of liberty is citizen responsibility.

American democracy and freedom is dependent upon our taking personal responsibility for understanding our most important economic and political issues. This is one of them.

“A mere demarcation on parchment of the constitutional limits (of government) is not a sufficient guard against those encroachments which lead to a tyrannical concentration of all the powers of government in the same hands.” - James Madison, Federalist Paper #48, 1788Many Americans believe in the US without understanding our major economic and government policies. Collectively, American’s trust in our government to ethically create and manage money is so pervasive that few of us ever give this multi-trillion dollar issue a moment’s thought. As a teacher of economics, I hope this brief is helpful to your responsible citizenship.

“Political parties exist to secure responsible government and to execute the will of the people. From these great tasks both of the old parties have turned aside. Instead of instruments to promote the general welfare they have become the tools of corrupt interests, which use them impartially to serve their selfish purposes. Behind the ostensible government sits enthroned an invisible government owing no allegiance and acknowledging no responsibility to the people. To destroy this invisible government, to dissolve the unholy alliance between corrupt business and corrupt politics, is the first task of the statesmanship of the day.” – Theodore Roosevelt, “The Progressive Covenant With The People” speech (August, 1912; one year before passage of the Federal Reserve Act)

Endnote:

1 With greater context: Herman, C. Washington’s Blog. Federal Reserve, national debt nearly defeated during Great Depression; let’s finish the job. Feb. 8, 2012. http://www.washingtonsblog.com/2012/02/federal-reserve-national-debt-nearly-defeated-during-great-depression-lets-finish-the-job.html

The S&P 500’s median P/S ratio is the highest it’s been since 1964-03-31:

The S&P 500's median P/S ratio is the highest it's been since 1964-03-31:

* >+2 SD from the median.

src: @MebFaber

WTI oil could collapse below $30 as land-based storage approaches full capacity. Chart from Josh Ayers.

WTI #oil could collapse below $30 as land-based storage approaches full capacity. Chart from Josh Ayers.

Delayed Again?: No Rate Hike This Year – Morgan Stanley’s Zentner

Don’t expect the Federal Reserve to raise interest rates until 2016, Morgan Stanley’s chief U.S. economist told CNBC on Friday.

“The Fed wants to be raise rates this year,” Ellen Zentner said in an interview with “Closing Bell.”

However, “there’s a difference between what the Fed wants to do and what we think they will be able to do.”

Zentner said key economic data will stand in the central bank’s way, specifically lack of pick up in nominal wage growth and consumer prices, or core PCE inflation.

“The Fed wants to be raise rates this year,” Ellen Zentner said in an interview with “Closing Bell.”

However, “there’s a difference between what the Fed wants to do and what we think they will be able to do.”

Zentner said key economic data will stand in the central bank’s way, specifically lack of pick up in nominal wage growth and consumer prices, or core PCE inflation.

Repeat… The USD is going parabolic. Something somewhere is collapsing

Marketvane’s Bullish Consensus

for the $US hit 90% yesterday. At the beginning of March it was 83%.

Market bullish sentiment toward the dollar has not been this bullish

since the turn of the millenium. It is a very strong contrarian signal…

The common “narrative” out there is that the dollar squeeze is being

fueled by European sovereign and corporate entities scrambling for

dollars in order to pay dollar-denominated debt obligations. Yes, this

is part of the equation. But, just like in 2008, it is a sympton of a

castrophic underlying systemic problem. After all, the Fed has created

close to $4 trillion in new dollars, $2.6 trillion of which are sitting

in the excess reserve account of the big banks at the Fed earning

interest. That’s $2.6 trillion in excess dollars that can used to fund any excess demand for dollars.

The common “narrative” out there is that the dollar squeeze is being

fueled by European sovereign and corporate entities scrambling for

dollars in order to pay dollar-denominated debt obligations. Yes, this

is part of the equation. But, just like in 2008, it is a sympton of a

castrophic underlying systemic problem. After all, the Fed has created

close to $4 trillion in new dollars, $2.6 trillion of which are sitting

in the excess reserve account of the big banks at the Fed earning

interest. That’s $2.6 trillion in excess dollars that can used to fund any excess demand for dollars.

Rate cuts: 24 so far and there’s more to come

An interest rate cut from South Korea Thursday takes the number of central banks that have stepped up their monetary easing this year to 24 and that number is likely to rise, analysts say.

South Korea’s decision to cut its key rate by 25 basis points to a record low of 1.75 percent follows a rate cut by Thailand’s central bank on Wednesday and easing by central banks in China, India and Poland since March began.

Read MoreBank of Korea joins the global easing spree

Russia and Malaysia are among the countries that economists say could join the growing list of central banks that have slashed borrowing costs since the start of the year.

….

The US Dollar index is going parabolic. More often

than not, markets that go parabolic will crash. This is what happened

with the dollar in 2008 (click to enlarge):

image: http://investmentresearchdynamics.com/wp-content/uploads/2015/03/USDX1.pngRate cuts: 24 so far and there’s more to come

An interest rate cut from South Korea Thursday takes the number of central banks that have stepped up their monetary easing this year to 24 and that number is likely to rise, analysts say.

South Korea’s decision to cut its key rate by 25 basis points to a record low of 1.75 percent follows a rate cut by Thailand’s central bank on Wednesday and easing by central banks in China, India and Poland since March began.

Read MoreBank of Korea joins the global easing spree

Russia and Malaysia are among the countries that economists say could join the growing list of central banks that have slashed borrowing costs since the start of the year.

….

“Fundamentally, the easing around the world is driven by inflation

turning out lower across the board,” Anatoli Annenkov, senior European

economist at Societe General, told CNBC.

“There is a debate about currency wars, monetary easing to push currencies lower, but fundamentally this is a story about growth and inflation,” he added.

“There is a debate about currency wars, monetary easing to push currencies lower, but fundamentally this is a story about growth and inflation,” he added.

Here’s a map showing which central banks have fired their opening salvo in 2015.

http://www.marketwatch.com/story/the-currency-wars-have-begun-2015-03-06?mod=mw_share_twitter

http://www.marketwatch.com/story/the-currency-wars-have-begun-2015-03-06?mod=mw_share_twitter

Gold Is A “Financial Nuclear Weapon”, China To Control The Gold Market | Alasdair MacLeod

IN THIS INTERVIEW:

– How will the change in London gold fix affect the physical gold market? ?0:18

– China to control the gold market ?6:43

– Gold is a “financial nuclear weapon” ?18:50

– Will the Euro currency survive? ?22:39

SUBSCRIBE (It’s FREE!) to our sponsor: Reluctant Preppers, “Helping You Be Aware and Prepared” ?http://bit.ly/ReluctantPreppers– How will the change in London gold fix affect the physical gold market? ?0:18

– China to control the gold market ?6:43

– Gold is a “financial nuclear weapon” ?18:50

– Will the Euro currency survive? ?22:39

SUBSCRIBE (also FREE!) to “Finance and Liberty” for more interviews and financial insight ?http://bit.ly/Subscription-Link

FINANCE AND LIBERTY:

Website ? http://FinanceAndLiberty.com

Like us on Facebook ?http://fb.com/FinanceAndLiberty

Follow us on Twitter ?http://twitter.com/Finance_Liberty

Google Plus ?http://Gplus.to/FinanceLiberty

Title and video graphics by Josiah Johnson Studios ?http://JosiahJohnsonStudios.com

Our sponsor Reluctant Preppers ?http://ReluctantPreppers.com

DISCLAIMER: The financial and political opinions expressed in this interview are those of the guest and not necessarily of “Finance and Liberty” or its staff. Opinions expressed in this video do not constitute personalized investment advice and should not be relied on for making investment decisions.

Currency Wars: In desperate move, SWIFT adds Russia to its board as a voting member

Source: The Daily Economist

Two days after China announced they were within months of implementing their own version of SWIFT to

compete and perhaps overtake the U.S. dollar as the globally recognized

reserve currency, the West does a U-Turn and has accepted Russia as a

voting member of their financial messaging and interchange system. This

move on March 11 comes just months after the U.S. threatened the

Eurasian oil giant with being locked out of SWIFT over

the Ukraine conflict, and appears now to be an act of desperation as

the dollar becomes less and less of a factor in global trade.

Share This Article...

Greece: what now?

By Moreno Pasquinelli

The arrogant outcry of many anti-euro people about a

“great betrayal” concerning to the agreement signed by Tsipras

government is irritating and risible.

Probably things are not like that.

It is a fact that the SYRIZA government, in return for some money that was urgently needed, undertook to effectuate most of the oppressive clauses of the old Memorandum enjoined by troika. But this is not all. SYRIZA also initiated emergency measures to help the lower classes which are the most touched by austerity policies.

Last but not least is the formal recovery of the national sovereignty which is, at least on paper, the end of the foreign protectorate regime.

Only those who know nothing about politics can underestimate the importance of these actions, considering that the only weapon that SYRIZA can use is the preservation of the broadest support of Greek citizens. The results of a recent survey, which was released by the most reliable opinion poll agencies, claim that the Tsipras government popularity has grown over 80%.

First question: what will happen in the following months if Greece is not able to honour the subscribed clauses? Such details are crucial. The agreement is, in fact, only theoretical for the moment. It will have to be put into practice and this progression involves several dangers. Using a sport metaphor we could state that the first leg was surely won by Germany. The rematch will take place in June or perhaps before, and its outcome is pretty hard to be forecast.

There’s a second question: what will happen in June if Greece discovers it didn’t win the complete trust of the markets and finds itself on the verge of default again, although it did its “homework” carefully? At that point the therapy imposed by the eurocratic synedrion would emerge as a flop once again and we would be back at square one. Can we really imagine that Tsipras, at that point, would go back to the German government asking with deference for a rollover, maybe with heavier terms, of the European “assistance”?

Or, instead, things could go in a very different way. The Greek government, after gaining time, could produce a “plan B”.

I don’t think that the SYRIZA leaders, although they support Europeanism (we have to remember that the old SYNASPISMOS, the actual executive core of SYRIZA , in 1992 voted the Maastricht Treaty) can exclude to take the possibility of a breaking-off with of the Eurozone into account.

In defiance of all forced talks about “victory” it is evident both to Tsipras and to Varoufakys that they were politically defeated at the negotiations.

They hoped they could break up the Euro-German bloc but on the contrary they were cornered and found themselves isolated. They aimed at “changing Europe “ but their plan were proved to be ambitious and even impossible. Only a fool could think that from now to August the relationships inside European Union can change. They will not change. If those “staunch Europeanist” have ears, let them hear.

Here is the third question: what sort of “B plan” do Tsipras and Varoufakys have?

I can venture a conjecture: in the face of the clear impossibility of getting out of debt and remaining in the Eurozone they will propose to Germany and to the European synedrion the possibility of a separation by mutual consent: a withdrawal from EU that is as painless as possible for the Greek people and not destructive for the Union.

Fourth question: will Germany accept a separation by mutual consent? Probably it will but only if Greece undertakes to pay back the main part of its debt. In nuce: separation but no default charged to the creditors.

During the rematch they will have to focus on this. The outcome will depend on the success or failure of the German war of attrition against the Tsipras government. This war was started by Germany in order to weaken and topple the Tsipras government and bring back its puppets regime. If SYRIZA is able to maintain its broad consensus among the Greeks (this is its main weapon, the second is a possible geopolitical shift towards Eastern Europe) the rematch results will not be facile.

I am certain that SYRIZA, after a forced setback (of course this was also due to its ignorance and cowardice) will not accept a second setback, which would be fatal. It would become itself an executioner in charge of crucifying Greek people. Tsipras cannot do anything else but refusing this macabre role so he will either pack his bags and call the election (at the risk of social and political chaos and really catastrophic results) or he will be bound to handle the default and the unilateral withdrawal from the Eurozone.

Postscriptum

Contrariwise to those who are getting ready to betray and leave the Greek people to their fate, crying about a “great betrayal of SYRIZA” we must keep a close eye on the Greek events which are really full of lessons to be learned for all of us and, just like in the past, we have to express our full solidarity to the Greek people, in spite of the many limitations of the Tsipras government.

Commerzbank fined $1.5bn for doing business with sanctioned Iran and Sudan

Reuters/Ralph Orlowski

Germany’s second biggest bank, Commerzbank, is to pay $1.45 billion (€1.36 billion) in fines to settle US Justice Department charges over transactions with sanctioned companies in Iran and Sudan.

From 2002-2008, the German bank cleared transactions worth $253 billion for Iranian and Sudanese companies that were sanctioned by the US. It used a method called ‘wire-stripping’ so as not to leave an identity on the transaction.

“Commerzbank concealed hundreds of millions of dollars in transactions prohibited by US sanctions laws on behalf of Iranian and Sudanese businesses,” said Assistant Attorney General Leslie Caldwell in a statement published by the Department of Justice on Thursday.

The Frankfurt-based bank, which has its US branch in New York, was accused of performing transactions for an Iranian shipping company linked to weapons of mass destruction. The bank continued to process more than $224 million worth of dollar transactions to 17 Sudanese banks when other banks wouldn’t. The Justice Department said Commerzbank used non-transparent methods.

“Commerzbank committed these crimes even though managers inside the bank raised red flags about its sanctions-violating practices. Financial institutions must heed this message: banks that operate in the United States must comply with our laws, and banks that ignore the warnings of those charged with compliance will pay a very steep price,” Caldwell said.

The US started levying sanctions against Iran in 2002 to deter Tehran from its nuclear ambitions. Comprehensive economic, trade and financial sanctions have been in place in Sudan since 1997 over the state’s support for international terrorism.

Commerzbank was found guilty by the US Justice Department for violating the International Emergency Economic Powers Act (IEEPA) and the Bank Secrecy Act (BSA).

It agreed pay a $610 million fine to the New York State Department of Financial Services (DFS), $200 million to the Federal Reserve; a $79 million fine for violating the International Emergency Economic Powers Act (IEEPA), as well as forfeit $563 million.

BNP Paribas was slapped with a much larger $8.8 billion fine in June for similar sanctions-related infractions.

Europe and Euro Collapsing, US Next, China’s Yuan Enters the Currency “Big Leagues” to Take On the Dollar, Monetary Base Falls, Germany’s Bundesbank Resumes Gold Repatriation from US Fed

Published on Jan 27, 2015

Market Volatility Increases, Open-Ended European QE (Markets Rally for 1 Day), Greek Elections: Who Will Win? What’s Next for France? China’s Yuan Enters the Currency “Big Leagues” to Take On the Dollar, Monetary Base Falls, Germany’s Bundesbank Resumes Gold Repatriation from US Fed, Criminal Syndicate Bank Fines Climb, How to Trade the Euro

The Holy Spirit Investment club is presented by InvestingwithInsight.com

at 10 AM, Saturdays, at the Morningstar Conference Center in Fort Mill, SC

Hosted by Ken & Valerie Storey

Market Volatility Increases, Open-Ended European QE (Markets Rally for 1 Day), Greek Elections: Who Will Win? What’s Next for France? China’s Yuan Enters the Currency “Big Leagues” to Take On the Dollar, Monetary Base Falls, Germany’s Bundesbank Resumes Gold Repatriation from US Fed, Criminal Syndicate Bank Fines Climb, How to Trade the Euro

The Holy Spirit Investment club is presented by InvestingwithInsight.com

at 10 AM, Saturdays, at the Morningstar Conference Center in Fort Mill, SC

Hosted by Ken & Valerie Storey

SWIFT Gives OBAMA the BIRD…..and RUSSIA a Seat On the Board

First, for those that don’t know, the

SWIFT system connects more than 10,000 banks in more than 200 countries

and provides the messaging that makes trillions of dollars of

international payments possible.

The US and Europe had been pressuring SWIFT to drop Russia from their systems like they did Iran. Russia pretty much said this would be an act of war if it happens because it would financially cripple them. But now, not only did SWIFT NOT kick Russia out,they actually gave them a seat on the board!!

http://www.forbes.com/sites/kenrapoza/2015/01/27/russia-to-retaliate-if-banks-given-swift-kick/

China Completes SWIFT Alternative, May Launch “De-Dollarization Axis” As Soon As September!

One of the recurring threats used by the western nations in their cold (and increasingly more hot) war with Russia, is that Putin’s regime may be locked out of all international monetary transactions when Moscow is disconnected from the EU-based global currency messaging and interchange service known as SWIFT (a move, incidentally, which SWIFT lamented as was revealed in October when we reported that it announces it “regrets the pressure” to disconnect Russia).

Of course, in the aftermath of revelations that back in 2013, none other than the NSA was exposed for secretly ‘monitoring’ the SWIFT payments flows, one could wonder if being kicked out of SWIFT is a curse or a blessing, however Russia did not need any further warnings and as we reported less than a month ago, Russia launched its own ‘SWIFT’-alternative, linking 91 credit institutions initially. This in turn suggested that de-dollarization is considerably further along than many had expected, which coupled with Russia’s record dumping of TSYs, demonstrated just how seriously Putin is taking the threat to be isolated from the western payment system. It was only logical that he would come up with his own.

more:

http://www.zerohedge.com/news/2015-03-09/de-dollarization-encircles-globe-china-completes-swift-alternative-may-launch-soon-s

NML

The US and Europe had been pressuring SWIFT to drop Russia from their systems like they did Iran. Russia pretty much said this would be an act of war if it happens because it would financially cripple them. But now, not only did SWIFT NOT kick Russia out,they actually gave them a seat on the board!!

Of course China and Russia are putting their own alterntative to SWIFT, CIPS, which is scheduled to go online in September.

http://rt.com/business/239581-swift-russia-board-traffic/http://www.forbes.com/sites/kenrapoza/2015/01/27/russia-to-retaliate-if-banks-given-swift-kick/

China Completes SWIFT Alternative, May Launch “De-Dollarization Axis” As Soon As September!

One of the recurring threats used by the western nations in their cold (and increasingly more hot) war with Russia, is that Putin’s regime may be locked out of all international monetary transactions when Moscow is disconnected from the EU-based global currency messaging and interchange service known as SWIFT (a move, incidentally, which SWIFT lamented as was revealed in October when we reported that it announces it “regrets the pressure” to disconnect Russia).

Of course, in the aftermath of revelations that back in 2013, none other than the NSA was exposed for secretly ‘monitoring’ the SWIFT payments flows, one could wonder if being kicked out of SWIFT is a curse or a blessing, however Russia did not need any further warnings and as we reported less than a month ago, Russia launched its own ‘SWIFT’-alternative, linking 91 credit institutions initially. This in turn suggested that de-dollarization is considerably further along than many had expected, which coupled with Russia’s record dumping of TSYs, demonstrated just how seriously Putin is taking the threat to be isolated from the western payment system. It was only logical that he would come up with his own.

more:

http://www.zerohedge.com/news/2015-03-09/de-dollarization-encircles-globe-china-completes-swift-alternative-may-launch-soon-s

NML

Subscribe to:

Comments (Atom)