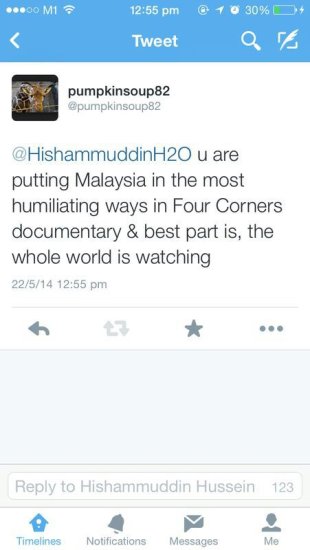

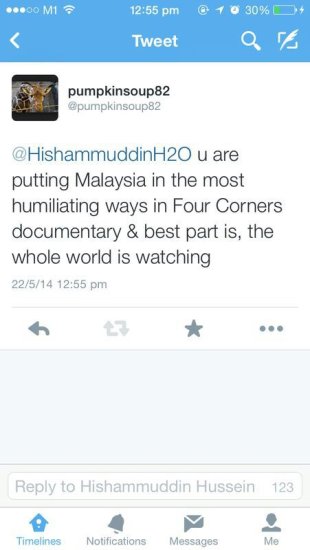

The families of flight MH370 passengers and crew have derided Datuk

Seri Hishammuddin Hussein’s weak defence of military inaction during the

early hours of the plane's disappearance, and in a show of anger some

have even demanded that he step down as the acting Transport Minister.

Hishammuddin told the Australian Broadcasting Corp in an interview

aired on Monday that the Malaysian military had been told to keep an eye

on the plane but allowed it to disappear off their radar after

considering it to be non-hostile.

His statements have drawn much flak from the families of those on board

the ill-fated jetliner, who said he has only fuelled more questions

instead of providing answers to the incident.

They also said the statements by Hishammuddin, who is also Defence

Minister, smacked of incompetence and that more honest people should be

allowed to lead the investigation into the aircraft’s disappearance,

instead of covering up the military’s and the government’s flaws.

Indian national Pralhad Shirsath whose wife was a passenger on the

plane, questioned how the plane was allowed to pass through Malaysian

airspace without any action taken, when the military knew that M370 was

missing or in trouble.

“If they have reason to hide information, they should tell us and

probably we will try to understand them". – Pralhad Shirsath, husband of

passenger on flight MH370.

He said the minister’s statement only showed that it was part of “a plan” to make the plane disappear with some purpose.

“Mr Transport Minister said, ‘If you're not going to shoot it down, what's the point of sending it up?’

"Well, he should understand that sending up military planes does not

always mean shooting it down, but rather investigating risk and taking

action (when it was already identified as a commercial jet and

non-hostile but travelling through Malaysian territory without

authorisation) in terms of giving feedback to those to whom the plane

belongs (I assume military did not know it was Malaysian flag carrier at

that time),” Shirsath told The Malaysian Insider when contacted.

“Or is it OK to fly over Malaysian territory without prior permission or clearance?” he asked.

Shirsath believed that the latest revelation only proved that the

Malaysian government was hiding more information from the families and

the public.

“If they have reason to hide information, they should tell us and probably we will try to understand them," he said.

Shirsath also said Malaysia’s image has been dented by the way the

government has dealt with the tragedy. He was puzzled as how the people

who ruled the country and those in charge of the search and rescue

operation managed to remain in power.

“How can Malaysian people tolerate these blunders? These leaders must

step down and more honest people should lead the investigation,” he

said.

“It is not too late, they should tell us all truth, stop misguiding the

media and families and make sure passengers and crew return to their

homes safely and we will forgive them,” he added.

Sarah

Bajc, the partner of passenger Philip Wood, echoed Shirsath’s

sentiment, saying it is both absurd and perilous for any civilian or

military flight observer to disregard an unidentified airplane.

“I believe the Malaysian people and the investigation into MH370 would

be well served by Hishammuddin’s resignation. My guess is that most feel

that way but I would not presume to speak for others,” she said.

Meanwhile, Syafinaz Hasnan, the sister of M370 crew Mohd Hazrin, described Hishammuddin’s statements as insensitive.

“I am saddened by the way the government has dealt with the military

issue. They are also very confused with their own twisted information.

Now everyone knows how incompetent they are and how vulnerable our

country can be,” she said.

K.S. Narendran, husband of Chandrika Sharma, one of the five Indian

nationals on board MH370, found the minister's stance and the defence

"outrageous".

He said what occured showed total neglect and incompetence on the part

of the various authorities in handling the incident, and urged

Hishammuddin to stop defending the indefensible by covering up military

flaws.

He also said the public was not easily taken in, regardless of whether

Hishammuddin had appeared sombre or savvy, contrite or confident,

collaborative or combative on television.

"The families and the world deserve to hear the truth and the only way

the government can hope to redeem themselves is by refusing to be the

agents of those who want to protect their interests, seeking forgiveness

for specific lapses and making amends," said Narendran.

Lokman Mustafa, whose sister was on board the plane, said the lack of

action from the military only revealed the mentality which resulted in

the Lahad Datu intrusion.

“Either our military men were not inquisitive enough, or just plain

lazy, which of course means a dereliction of duty. Or worse, could this

be a conspiracy to hide something?” he asked.

“Let’s put it this way, if we hear strange sounds on our roof, do we get out to check what’s causing it?

“We may, or may not... but because our military men are paid to ensure

our safety, they have to determine whether its hostile or otherwise.

Just because ‘we're not at war with anybody’ does not mean we should

allow any aircraft to trespass into our airspace and quietly glide out

to sea, because it might be Lahad Datu intruders again, or MH370. But I

guess some people never learn,” he said.

In the interview with ABC, Hishammuddin said the military did not send a

plane up to investigate as "it was not deemed a hostile object and

pointless if you are not going to shoot it down".

He said this in defence of the military’s failure to scramble a fighter

jet after flight MH370 had disappeared from civilian radar on March 8

when its transponder stopped transmitting around 1.21am during a flight

from Kuala Lumpur to Beijing.

The military radar tracked it after it made a turn-back and turned in a westerly direction across the peninsula.

"If you're not going to shoot it down, what's the point of sending it (a fighter) up?" Hishammuddin told ABC.

Delays in pinpointing the Boeing 777-200ER’s location led to days of

searching in the South China Sea before analysis from British satellite

firm, Inmarsat, pointed to the Indian Ocean as its likely course.

Hishammuddin had also said that had the jet been shot down with 239

passengers and crew on board, "I'd be in a worse position, probably".

He said he was informed of the military radar detection two hours later

and relayed it to Prime Minister Datuk Seri Najib Razak, who then

ordered a search in the Malacca Strait.

This was the first time that Malaysia has said that civil aviation

authorities told the military to keep an eye on the aircraft – a fact

which was not mentioned in the five-page preliminary report on the

plane's disappearance released by the Ministry of Transport on May 1.

The much-criticised preliminary report made no mention of the

instructions from the civil aviation authorities to the military to

monitor the plane.

Instead, the brief report, which was sent to the International Civil

Aviation Organisation (ICAO), revealed a chaotic four hours after

communications between Malaysia air traffic controllers, Malaysia

Airlines and other regional air traffic controllers, before a hunt was

initiated.

The Malaysian authorities have been severely criticised over their

handling of the investigations into the missing jetliner with the

international media, family members of passengers and crew, with the

public accusing them of hiding and delaying information.

A survey commissioned by The Malaysian Insider last month showed that

more than half of Malaysians polled believed that the Barisan Nasional

(BN) government had been hiding information about flight MH370's

disappearance. – May 23, 2014.