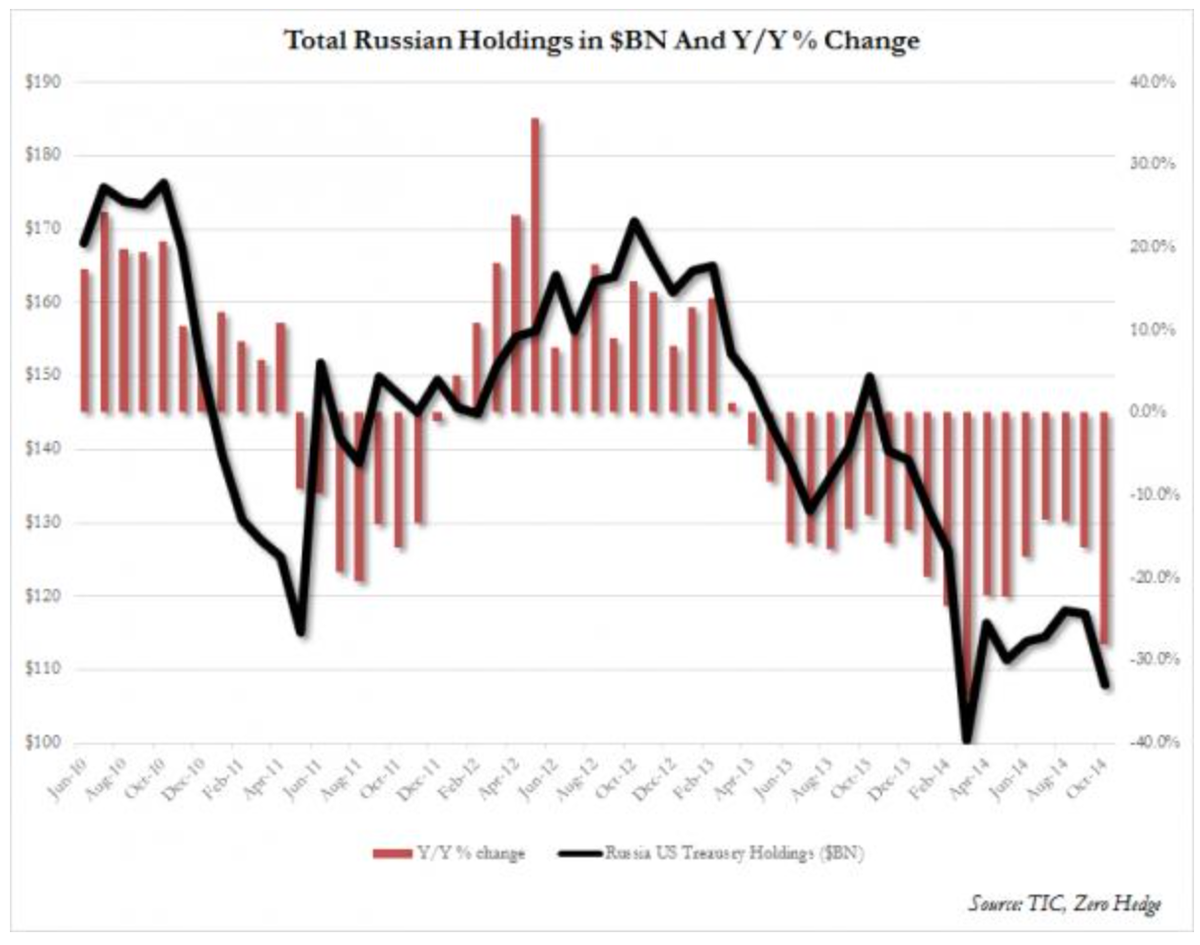

China, Russia Dump US Treasurys In October As Foreigners Sell Most US Stocks Since 2007 http://www.zerohedge.com/news/2014-12-15/china-russia-dump-us-treasurys-october-foreigners-sell-most-us-stocks-2007Treasuries …

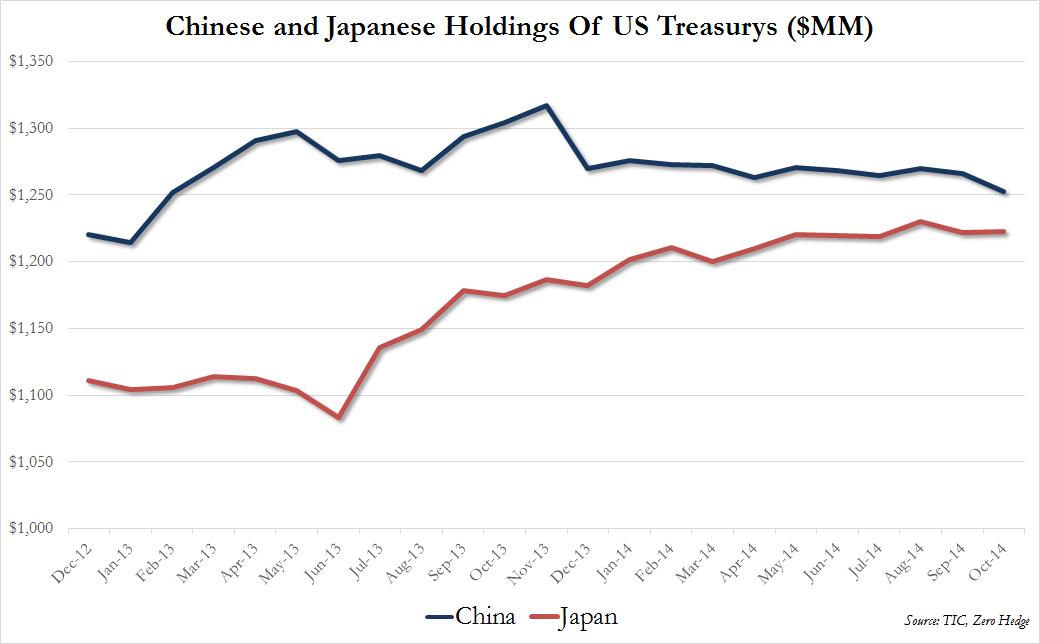

China vs Japan holdings of US Treasurys http://www.zerohedge.com/news/2014-12-15/china-russia-dump-us-treasurys-october-foreigners-sell-most-us-stocks-2007 …

Chinese Dump US Treasuries…

China’s holdings of U.S. Treasuries fell to a 20-month low in October, as yuan appreciation indicated less of an impetus to buy the government securities.

China held $1.25 trillion in U.S. debt as of October, a $13.6 billion drop from September, the Treasury Department said in a monthly report today. The nation remains the largest foreign holder, ahead of Japan, whose stockpile increased $0.6 billion to $1.22 trillion, reducing the gap between the two countries to the narrowest since September 2012.

The yuan rose 0.4 percent against the dollar in October as the government moves toward a market-determined exchange rate, part of efforts to expand the currency’s use worldwide. The less China intervenes to weaken its currency, the less it needs to buy securities such as Treasuries.

“The lack of growth in their Treasury portfolio has been happening throughout this year, so I tend to think it’s more of a structural trend that’s developing,” said Stanley Sun, an interest-rates strategy analyst at Nomura Securities International Inc. in New York. He said he expects “a grind lower rather than any sharp decline” in holdings.

While the yuan has weakened 1.3 percent since October, it’s still the only one among 31 major global currencies tracked by Bloomberg to strengthen against the dollar in the second half.

http://www.bloomberg.com/news/2014-12-15/china-s-treasury-holdings-decline-to-lowest-since-february-2013.html

China’s holdings of U.S. Treasuries fell to a 20-month low in October, as yuan appreciation indicated less of an impetus to buy the government securities.

China held $1.25 trillion in U.S. debt as of October, a $13.6 billion drop from September, the Treasury Department said in a monthly report today. The nation remains the largest foreign holder, ahead of Japan, whose stockpile increased $0.6 billion to $1.22 trillion, reducing the gap between the two countries to the narrowest since September 2012.

The yuan rose 0.4 percent against the dollar in October as the government moves toward a market-determined exchange rate, part of efforts to expand the currency’s use worldwide. The less China intervenes to weaken its currency, the less it needs to buy securities such as Treasuries.

“The lack of growth in their Treasury portfolio has been happening throughout this year, so I tend to think it’s more of a structural trend that’s developing,” said Stanley Sun, an interest-rates strategy analyst at Nomura Securities International Inc. in New York. He said he expects “a grind lower rather than any sharp decline” in holdings.

While the yuan has weakened 1.3 percent since October, it’s still the only one among 31 major global currencies tracked by Bloomberg to strengthen against the dollar in the second half.

http://www.bloomberg.com/news/2014-12-15/china-s-treasury-holdings-decline-to-lowest-since-february-2013.html

No comments:

Post a Comment