If that 500-point storm midweek didn’t open the selling floodgates, maybe retail investors are a bit more patient than they get credit for. After all, while the headlines screamed blood in the streets, investors bought the dip in what Fidelity said was one of the 10 busiest retail trading days ever.

And what then? “At some juncture in the not too distant future,” Stockman wrote, “the stock averages are going to break this trading range, and plunge back down to earth.”

The WSJ’s Jason Zweig also wrote about misconceptions in his latest piece, and why there’s no reason to suggest all this volatility necessarily means a bottom is near. “As the behavior of many individual investors has been showing,” he says, “we are a long way from the quiet despair that has so often been a sign that stocks have finally reached bargain prices.”

Whether that “quiet despair” begins to creep in this week could depend on what we hear out of the high-profile crop of tech earnings, including Apple AAPL, -0.38% on Tuesday. Facebook FB, +0.22% Amazon AMZN, -0.11% and Microsoft MSFT, -0.46% will also be peppering eager investors with numbers in the coming days. For now, there still seems to be some buying interest spilling over from last week’s advance.

Key market gauges

Dow YMH6, -0.48% and S&P ESH6, -0.49% futures are pointing lower. Gold GCH6, +0.97% continues to push for a comeback with a decent gain. Crude CLH6, -3.45% is lower, hovering below $32 a barrel. In Asia ADOW, +1.16% stocks banged out an advance while Europe SXXP, -0.74% is down after investors were in the mood to nibble earlier.The buzz

Twitter TWTR, -5.27% shares are down 5%. It should be pretty busy today after reports of a major shake-up at the top surfaced over the weekend. Katie Jacobs, Twitter’s vice president of global media, and Kevin Weil, senior vice president of product, are on the way out. Chief Executive Jack Dorsey had this to say about those departures. At least one downgrade has rolled in this morning from Stifel.Johnson Controls JCI, +0.42% and Tyco International TYC, +6.86% agreed to merge in a deal that will put the combined company’s headquarters in Ireland. Tyco shares are up 5% and Johnson Controls is off 2%.

Caterpillar CAT, -3.61% is down 3% after Goldman cut it to sell.

The economy

There are plenty of numbers for traders to sift through this week, such as the first estimate of fourth-quarter GDP and December new home sales. The Fed is meeting Tuesday and Wednesday but no major fireworks are expected. “This is not a live meeting for the Federal Reserve in the sense no change in policy can be reasonably expected,” Marc Chandler of the Marc to Market blog wrote. “Whatever the Fed means by gradual, it does not mean a rate hike at consecutive meetings.” As for today, the Dallas Fed manufacturing survey hits at 10:30 a.m. Eastern.The call

Time to tread lightly on dividend stocks? That may seem counter-intuitive in a market environment where playing it safe seems to be all the rage. But Barron's is suggesting just that, despite the outperformance of the group so far this year. “Dividend-paying stocks might not be as safe as they look,” writes Ben Levisohn. “That’s because companies have been raising their dividends while their earnings growth has slowed or even evaporated altogether.” He added that not only is that unlikely to change but it could be getting even worse without the necessary profits.The chart

The stat

1,934 contracts — That’s the latest tally of the net-long position in gold futures and options, according to Bloomberg. Last week, that number stood at 902. To put the shift in perspective, at the end of the year, there was a record net-SHORT position of 24,263 in the safe haven metal.Random reads

Miss the blizzard? Here’s a cool time lapse.Showtime’s new financial drama is exhausting.

This beetle could help make frost a non-issue for airplanes.

This is what a dead football player’s brain looks like.

The true story behind “The Revenant” is gnarlier than the movie.

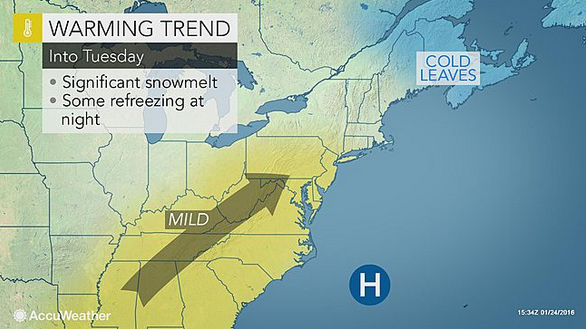

Hey, it’s warming up:

A brief early-week warmup will aid blizzard recovery across the northeastern US http://ow.ly/XtIC7

No comments:

Post a Comment