What I’m about to tell you is not my

own opinion or even analysis. It’s original data that comes from the

United States Federal Reserve and national credit bureaus.

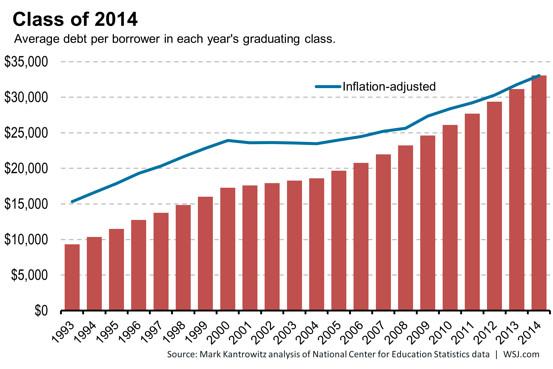

- 40 million Americans are now in debt because of their university education, and on average borrowers have four loans with a total balance of $29,000.

- According to the Fed, “Student loans have the highest delinquency rate of any form of household credit, having surpassed credit cards in 2012.”

- Since 2010, student debt has been the second largest category of personal debt, just after a home mortgage.

- The delinquency rate for student loans is now hovering near an all-time high since they started collecting data 12 years ago.

- Only 37% of total students loan balances are currently in repayment and not delinquent.

The rest—nearly 2 out of 3—are either behind on payments, in

all-out default, or have entered some sort of deferral program to delay

making payments, with a small percentage still in school.

It’s pretty obvious that this is a giant, unsustainable bubble

(more on this below). But even more important are the personal

implications.

No comments:

Post a Comment