(Bloomberg) — Hedge

funds are betting that gold’s recent rally won’t last and are holding

the biggest wager ever that prices will decline.

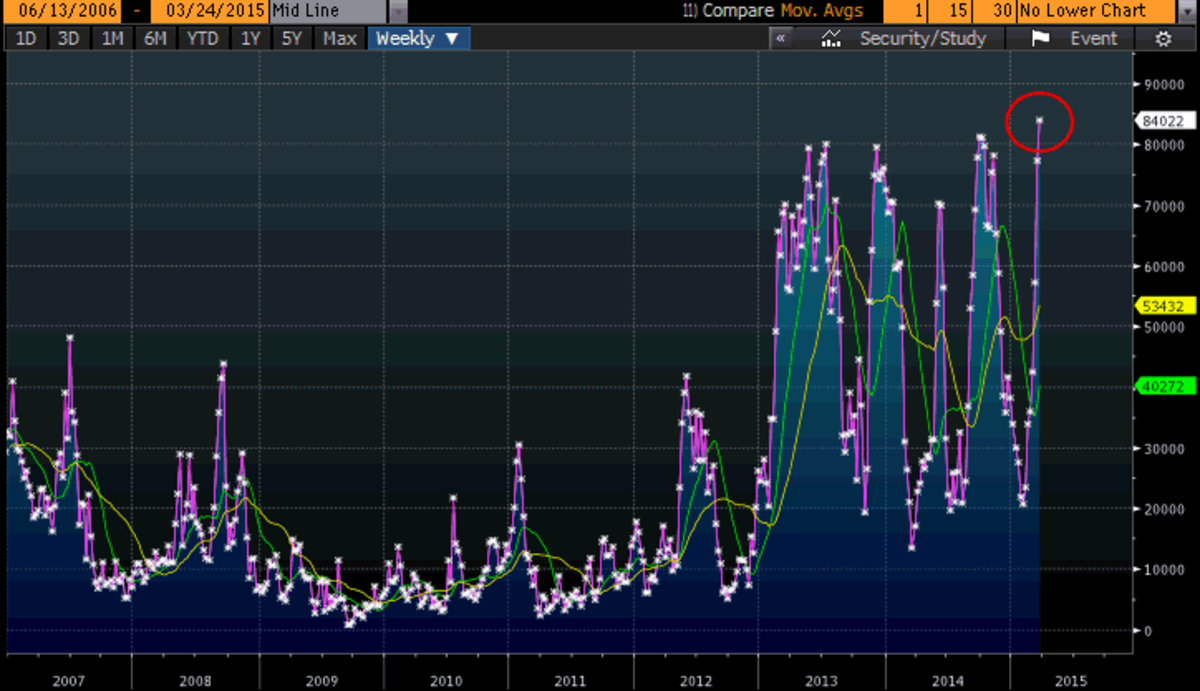

The net-long position in gold dropped by 9.9 percent to 31,653

futures and options in the week ended March 24, according to U.S.

Commodity Futures Trading Commission data published three days later.

That was the lowest since December 2013. Short holdings rose for a

seventh straight week to 84,022 contracts, the highest since the data

begins in 2006.Even as futures climbed for two straight weeks, some investors have shied away from the metal. Global holdings in exchange-traded products backed by bullion declined every week in March. The dollar is headed for the longest run of monthly advances since at least 1967 against a basket of six currencies, lowering demand for gold as an alternative investment.

“Most of the hedge funds are relying on dollar strength as being the primary determining factor in decreasing positions,” Jeff Sica, who oversees $1.5 billion as president and chief executive officer of Circle Squared Alternative Investments in Morristown, New Jersey, said by telephone March 27. “As long as we see dollar strength, you’re going to see the hedge funds get progressively less bullish.”

Most-active futures that rose 4.2 percent in the two weeks through March 27 on the Comex in New York settled 1.3 percent lower at $1,185.30 an ounce in New York on Monday.

http://www.bloomberg.com/news/articles/2015-03-29/hedge-funds-bet-gold-gain-to-fizzle-as-short-wagers-reach-record

No comments:

Post a Comment