- An illuminated EU referendum sign in Manchester Town Hall on Thursday.

- Reuters

It’s official — the U.K. has voted to leave the European Union. There’s a sense of shock after opinion polls suggested voters would reject a Brexit.

Stock markets in London and Europe sold off sharply at the open, with British bank shares taking a particular hit. The pound is on a downward trajectory.

British Prime Minister David Cameron announced he will step down Friday morning, saying the negotiations for withdrawal from the EU should be carried out by a new leader. His replacement is expected to be selected by October.

“The will of the people to leave the EU must be respected,” British Prime Minister David Cameron said in a statement Friday. “We must now prepare for a negotiation with the European Union.”

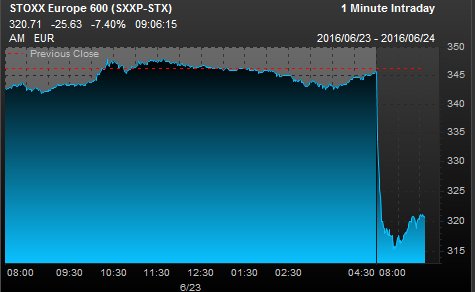

Stoxx Europe 600 falling off a cliff after U.K. votes to Brexit. Faces worst day since 1987http://www.marketwatch.com/story/european-stocks-face-worst-day-since-1987-as-uk-votes-to-ditch-the-eu-2016-06-24?mod=MW_story_latest_news …

- Bank of England Governor Mark Carney sought to calm financial markets on Friday morning, vowing to take all necessary measures to ensure financial stability after the U.K. voted to leave the European Union.

In a public statement after the historic vote to Brexit, the central bank governor said the BOE is closely monitoring the fallout from the referendum and is working with other central banks to preserve stability.

“We have taken all necessary steps to prepare for this event,” Carney said. “We won’t hesitate to take more measures.”

The BOE governor also said the bank stands ready to provide £250 billion ($344.48 billion) in additional funds to the financial system.

- 3:36 pm

- 'Complete disaster'

- Add a Comment

Analysts have started reacting to the news that U.K. Prime Minister David Cameron has resigned.

“This a complete disaster but this was expected. Now we have political uncertainty, economic uncertainty, consumer confidence may crash even further and the property market may be hit even harder,” said Naeem Aslam, chief market analyst at ThinkForex, in a note.

“We have an environment under which we do not know who is going to lead the country. Bookies will have another thing to play – who will lead the country and names like Boris and Nigel Farage have popped up.”

- 3:32 pm

- U.K. Prime Minister resigns

- Add a Comment

The U.K.’s Prime Minister David Cameron said Friday morning he will resign, after Britain voted to leave the European Union in a hotly fought referendum. Cameron had been campaigning for the “remain” side, arguing the U.K. would be safer, stronger and better off economically inside the union.

During a speech after the Brexit results were announced, the prime minister said the break-up negotiations with Europe need to take place under a new leader. The new prime minister will take over in October, he said.

“Leaving Europe is not the path I recommended,” Cameron said. “I will do everything I can to help the U.K. succeed.”

- 3:18 pm

- Markets sell off at European open

- Add a Comment

Stocks are selling off in the U.K. and Europe as the markets open, and it’s carnage out there. British banks are taking a particular hit, as are home builders. Trading was halted in numerous stocks in Europe at the start, though they’re tricking back.

Here’s a rundown, but this is likely to be a snapshot of the situation as volatility hits:

- FTSE 100 now down 7.6%

- Stoxx 600 falls 8.2%

- Stoxx banking index slumps 10%

- Royal Bank of Scotland tanks 28%

- Taylor Wimpey loses 25%

- Societe Generale plungs 30%

- Randgold Resources rallies 28%

- Gold jumps 5% to $1,328 an ounce

- Oil drops 4.8% to $47.72 a barrel

- Dow average stock futures lost 522 points to 17,397

- 2:34 pm

- It's official -- the U.K. is leaving the EU

- Add a Comment

It’s official — the U.K. has voted to Brexit.

Shortly before 7:30 a.m. London time, or 2:30 a.m. Eastern Time, Jenny Watson, chairperson of the United Kingdom Electoral Commission, made the official declation that the U.K. has voted to leave the union, with 51.9% backing an exit vote.

- 1:53 pm

- U.K. to lose AAA credit rating after Brexit

- Add a Comment

The U.K. stands to lose its AAA credit rating with Standard & Poor’s Ratings Services, the Financial Times reports on Friday.

Moritz Kraemer, the chief ratings officer for S&P, confirmed to the newspaper that he expects the political and economic consequences of a Brexit to lead to a credit downgrade in the near future.

“We think that a AAA-rating is untenable under the circumstances,” Kraemer told the FT.

- 1:41 pm

- Brussels wakes up to new reality

- Add a Comment

Brussels wakes up to a new reality — it has to unwind a 43-year-old relationship with the U.K. after the “leave” side won in the closely watched Brexit referendum.

Dutch Prime Minister Mark Rutte, whose country holds the rotating presidency for the EU, will meet with European Commission President Jean-Claude Juncker and European Council President Donald Tusk, Friday morning in Brussels, according to The Wall Street Journal.

Later in the day, European and foreign affairs ministers will have Brexit on top of their agenda at a meeting in Luxembourg.

Leading European politicians reacted with shock to the decision in the early hours of Friday morning. Alexander Stubb, former Finnish prime minister, wished it was all a terrible dream.

- MarketWatch will be live from London on Facebook as the Brexit vote results come in early Friday. Hope you’ll join us!

https://www.facebook.com/marketwatch

- 1:10 pm

- Pound at $1.20?

- Add a Comment

The pound has already slumped to a 31-year low, but more weakness is in store for sterling as the consequences of a Brexit unfolds, according to HSBC.

In a note out early Friday morning, the bank’s currency strategists forecast the pound will fall to $1.25 by the end of the third quarter and to $1.20 by the end of the year.

“This is a seismic and largely unexpected event which is likely to have a massive impact on financial markets,” the analysts said.

“GBP-USD will remain under substantial pressure, and could fall by around 15-20% from the high of 1.50,” they added.

Sterling traded around $1.3408 in early trade Friday, down 10%after it became clear the U.K. has voted to leave the EU it has been a member of since 1973.

- 12:57 pm

- Some scary charts out there

- Add a Comment

- 12:57 pm

- Add a Comment

We’re just waiting for the last 13 counting areas to declare referendum results and then it will be official that the U.K. has voted to leave the European Union.

With 369 out of 382 areas done with counting, the “leave” vote is ahead with 51.7% versus 48.3% for the “remain” camp.

The decision to sever ties with the EU has come as a shock to financial markets, with all risk assets selling off heavily. The pound is down 10% against the dollar at $1.3382, the lowest it’s been since 1985.

“U.K. voters have made their voices heard, and now begins the difficult task of designing an exit from the European Union,” said Tim Adams, president of the Institute of International Finance.

“The full extent of the financial market and economic impact from Brexit will not be clear for some time, but it is sure to be very disruptive in the short term and a drag on economic growth and employment in the longer term – especially for the U.K. itself,” he added.

- 12:37 pm

- Markets go mad on Brexit vote

- Add a Comment

Market carnage is the only way to describe the trading action as it becomes clear the U.K. has voted to leave the European Union.

Here’s a rundown of the most significant market moves:

- The pound slumps 10% to trade at $1.3322, the lowest since 1985

- FTSE 100 futures down 8.4% at 5,760, indicated biggest loss since 2008

- Nikkei 225 index, down 7.6%, suspended for trade as circuit breakers kick in

- U.S. stock futures slump, with Dow Jones Industrial Average futures down 3.8%

- Gold rallies 4.9% to $1,324.80

- Oil tanks 5.7% to $47.24 a barrel

- 11:59 am

- Add a Comment

The U.K. is on track to leave the European Union, according to broadcasters BBC and ITV. In the early hours of Friday morning the two news stations forecast that the “leave” campaign has won the Brexit referendum and that the U.K. will sever its ties with the union it’s been a member of since 1973.

The Sky News results tracker also put the exit side ahead with 51.7% versus 48.3% for the “remain” side, with 322 out of 382 counting areas having declared results.

The pound slumped to $1.3329, the lowest it’s been against the dollar since 1985.

The final result — expected around breakfast time in the U.K. — will mark an end to four months of fierce campaigning that has unleashed an emotional public debate about immigration and the future of the U.K. economy.

Brexiteers have argued the U.K. would be better off free from Brussels’s regulatory restraints and that cutting ties with the EU is the only way the country can control immigration. The “remain” camp, on the other hand, has warned that a goodbye to the union would trigger a wave of economic uncertainty, possibly plunging the U.K. and other European economies into recession.

- 11:37 am

- Markets jolted by Brexit vote

- Add a Comment

Global markets were shaken to their core early Friday morning as the running total of votes in the Brexit referendum put the “leave” campaign in the lead.

The Brexiteers were ahead with 51.5% of the votes versus 48.5% for the “remain” side, with 289 out of 382 counting areas having declared results, according to the Sky News results tracker.

Here are some of the biggest market moves:

- The pound slid below $1.35 for the first time since 1985

- Futures for the FTSE 100 sank 7.5% to 5,810

- Futures for U.S. stocks were also sharply lower, with those for the Dow Jones Industrial Average down 487 points, or 2.7%, at 17,425

- The yen rallied past 100 per dollar

- Gold jumped 4.3% to $1,317 an ounce

- Crude oil slumped 5.1% to $47.54 a barrel

- 11:27 am

- Pound breaks below $1.35

- Add a Comment

The pound dropped below $1.35 for the first time since 1985 in early Friday trading hours as early results from the U.K.’s referendum on its European Union membership pointed to a “leave” vote.

Sterling slumped to as low as $1.3463, before rebounding slightly to $1.3607. With 265 of 382 counting areas having declared results, 51.4% of the voters backed a Brexit versus 48.6% that favored to remain part of the union.

The pound had late Thursday jumped to as high as $1.5022 on early indications the U.K. had voted to stay in the bloc. However, as more local results were announced the vote swung in favor of the Brexiteers.

- 11:03 am

- Yen rallies

- Add a Comment

Yen soars past 100 per dollar for first time since 2013 as Brexit camp stays ahead in U.K. EU referendum

- 10:20 am

- Mapping the results

- Add a Comment

- 10:09 am

- Add a Comment

- 10:02 am

- Markets too complacent?

- Add a Comment

Our columnist Brett Arends wrote on Wednesday that markets were far too complacent about risks of Brexit.

“We are now seeing why,” he said early Friday morning after the release of the first local Brexit results came out.

“Investors who had bet heavily on Remain ahead of the vote were very foolish: Not because they should have foreseen the results, but because the downside risks of Brexit vastly outweighed the benefits of Remain,” he added. “Blame Groupthink – as usual.”

- 9:59 am

- Booking odds swing wildly

- by Brett Arends

- Add a Comment

More Brexit commentary from Brett Arends:

“Betting markets are swinging wildly with the results. Half an hour ago, they were among Leave the clear favorite. Now they have gone back the other way. Oddschecker says the bookies offer Remain at 8/11 and Leave at 11/8,” he says.

“The key issue will be London and its suburbs. They contain a huge number of votes, they are strongly pro-Europe, and their results are just starting to come in.”

No comments:

Post a Comment