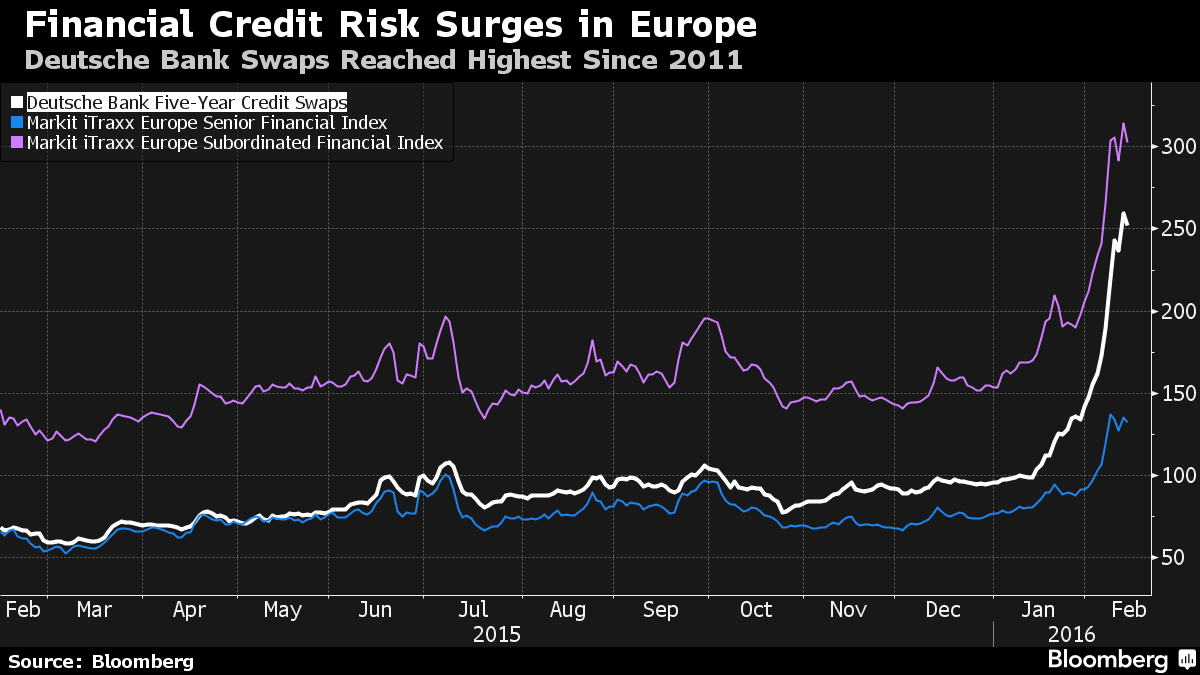

Credit-Default Swaps Are Back as Investor Fear Grows http://bloom.bg/1V9t1nS

-

Credit derivatives trade volumes doubled over the past month

-

Barometers of risk rose to multi-year highs this week

As markets plunge globally, investors are seeking refuge in an all-but-forgotten place.

Trading volumes in the credit-default swaps market — where banks and

fund managers go to hedge against losses on corporate and government

debt — have surged. Transactions tied to individual entities doubled in

the four weeks ended Feb. 5 to a daily average of $12 billion, according

to a JPMorgan Chase & Co. analysis of trade repository data. The

volume of contracts on benchmark indexes in the market increased

two-fold during that period to an average of $87 billion a day.The growth could represent a shift. The credit derivatives market has contracted for almost a decade, after loose monetary policies triggered a big rally in assets including corporate bonds, which made investors less eager to protect against the worst. Regulators have also urged banks to curb their risk taking, reducing the appetite for at least some dealers to trade the instruments. Now, stock markets are selling off and junk bond prices are plunging, increasing investor demand for protection.

“The surge we’ve seen in trading is likely to stay with us for the foreseeable future,” said Geraud Charpin, a portfolio manager at BlueBay Asset Management in London, which oversees $58 billion and has traded more credit-default swaps on individual credits in the past three months. “The credit cycle has turned, so there’s more appetite to go short and buy protection.”

Risk measures fell on Friday after soaring this week to the highest levels since at least 2012 in the U.S., and 2013 in Europe. The cost of insuring Deutsche Bank AG’s subordinated debt dropped from a record after the German lender said it planned to buy back about $5.4 billion of bonds to allay investor concerns about its finances. The bank’s shares have lost about a third of their value this year.

http://www.bloomberg.com/news/articles/2016-02-12/credit-default-swaps-are-back-as-investors-look-for-panic-button

No comments:

Post a Comment